Analysis of the current status of Zimbabwe''s

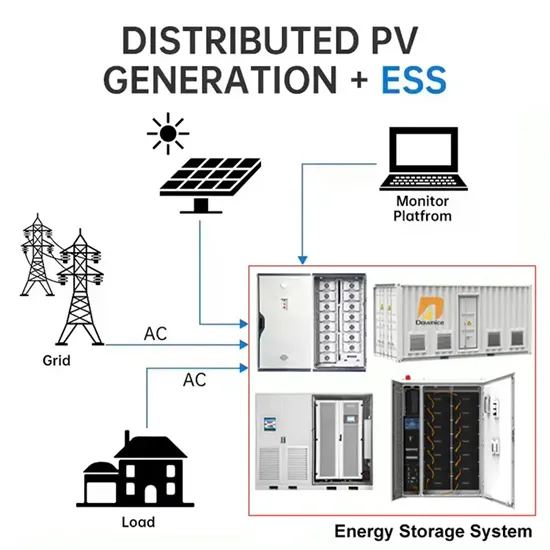

- The government has set a target of "renewable energy accounting for 27% by 2030", and household photovoltaic + energy storage

Get Price

New Tax Burdens for Zimbabwe''s Mining Sector in 2025: Impact

As the industry adapts to the new fiscal landscape, this article examines the key tax provisions in the 2025 Budget and the Finance Act, alongside their likely implications for

Get Price

Unreliable Power Forces Miners to Pay More Taxes Due to Lack

Currently, Zimbabwe charges a beneficiation tax of up to 5% on unrefined platinum exports as a disincentive to the export of raw minerals. However, Mnangagwa

Get Price

An Overview of Tax Changes in Zimbabwe (2025

The article looks at the taxes in Zimbabwe. An overview of the tax changes in Zimbabwe as of 2025, and the different types of taxes available.

Get Price

Zimbabwe Energy Storage Power Plant Operation: Powering the

Zimbabwe''s Energy Storage Game Changer A country where 40% of urban households use generators daily (World Bank, 2022) suddenly starts testing giant battery farms. That''s

Get Price

Country Assessment Report: Zimbabwe

The Zimbabwe Energy Regulatory Authority (ZERA) is also developing a renewable energy feed in tariffs, which is designed to encourage and support greater private sector participation in

Get Price

Zimbabwe Customs Import and Export Taxes and fees

This article provides a detailed overview of Zimbabwe''s customs import and export taxes and fees, including customs duty, excise duty, value-added tax (VAT), and surtax, administered by

Get Price

Zimbabwe solar electricity storage

Why is energy storage important in Zimbabwe? In Zimbabwe,the power crisisand increasing integration of renewable energy sources like solar PV and the largely accepted bioenergy

Get Price

Government introduces solar equipment tax rebate –

ZIMBABWE has introduced a duty rebate on imported equipment and machinery specifically intended for establishing solar-powered charging

Get Price

ESG & Tax in Zimbabwe: A Comprehensive Overview

Export-Based Tax Rates: Preferential rates based on export percentages, with lower rates for higher export volumes (e.g., 15% for exports over 51%). Taxes are an integral

Get Price

Power Outages, High Taxes, High Operational Costs

As Zimbabwe''s mining sector faces an increasingly challenging landscape, rising operational costs, power outages, and high taxes continue to

Get Price

Zimbabwe Energy Situation

The sector is primarily controlled by the state-owned company, Zimbabwe Electricity Supply Authority Holdings (ZESA Holdings, ),

Get Price

Tax Framework in Zimbabwe

This article looks at the tax framework in Zimbabwe and the tax laws which are governed by ZIMRA, also some of the taxes in Zimbabwe.

Get Price

Zimbabwe Lithium Export Tax Delay: What Miners Want

Discover why Zimbabwe''s lithium miners seek a tax delay until 2027 as the country balances export revenue with processing goals.

Get Price

Zimbabwe Tax Budget Guide 2022 / 2023

Review of flat of excise duty on energy drinks rate from US$0,05 to US$0.10 per litre, with effect from ("w.e.f.") 1 January 2023. To expand the list of capital equipment to be zero rated for

Get Price

ESG & Tax in Zimbabwe: A Comprehensive Overview

Export-Based Tax Rates: Preferential rates based on export percentages, with lower rates for higher export volumes (e.g., 15% for exports

Get Price

Zimbabwe | SpringerLink

Zimbabwe is a landlocked, southern African nation home to around 14,830,000 people [1]. Zimbabwe, formerly part of the British colony of Southern Rhodesia, has been an

Get Price

Tax incentives for renewable energy – Policies

Zimbabwe has several investment incentives through tax and customs exemptions, which can be used to support renewable energy projects. Duties and Value Added Tax. Solar and electrical

Get Price

Understanding Taxation Under Zimbabwean Law: A

This article offers a detailed overview of the core taxes applicable in Zimbabwe under the current legal framework, including applicable rates, exemptions, and the obligations of taxpayers in 2025.

Get Price

Zimbabwe Electricity Statistics

Electricity generation and consumption, imports and exports, nuclear, renewable and non-renewable (fossil fuels) energy, hydroelectric, geothermal, wind, solar energy

Get Price

Unreliable Power Forces Miners to Pay More Taxes

Currently, Zimbabwe charges a beneficiation tax of up to 5% on unrefined platinum exports as a disincentive to the export of raw minerals.

Get Price

Zimbabwe Tax Incentives

Exporters benefit from reduced tax rates and VAT refunds, while SMEs are increasingly integrated into the formal economy through compliance measures. The focus on renewable energy and

Get Price

The impact of the reduction in export tax rebates for

On November 15, 2024, China''s Ministry of Finance announced a policy adjustment, reducing the export tax rebate rate for the photovoltaic and

Get Price

New Tax Burdens for Zimbabwe''s Mining Sector in

As the industry adapts to the new fiscal landscape, this article examines the key tax provisions in the 2025 Budget and the Finance Act,

Get Price

ZIMBABWE''S TAX INCENTIVES THE INVESTOR''S GUIDE

Tax Rates Allowance is optional, and once claimed, this replaces wear and tear (depreciation). SIA is provided at a rate of 25% of cost from the year of such expenditure.

Get Price

More related information

-

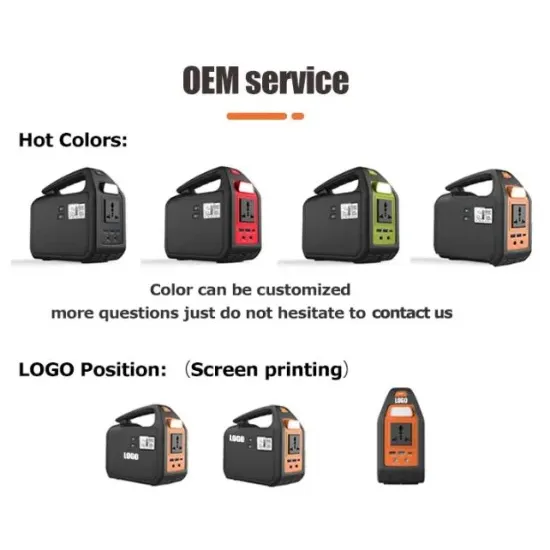

Tax rate for portable energy storage power supply

Tax rate for portable energy storage power supply

-

Hybrid energy storage power station conversion rate

Hybrid energy storage power station conversion rate

-

What is the tax rate for power storage projects

What is the tax rate for power storage projects

-

What are the wind solar and energy storage power stations in Zimbabwe

What are the wind solar and energy storage power stations in Zimbabwe

-

Hybrid power supply for Zimbabwe s communication base station energy storage system

Hybrid power supply for Zimbabwe s communication base station energy storage system

-

Zimbabwe Customized Mobile Energy Storage Power Supply Factory

Zimbabwe Customized Mobile Energy Storage Power Supply Factory

-

Huawei energy storage power export

Huawei energy storage power export

-

Will Zimbabwe build an energy storage power station

Will Zimbabwe build an energy storage power station

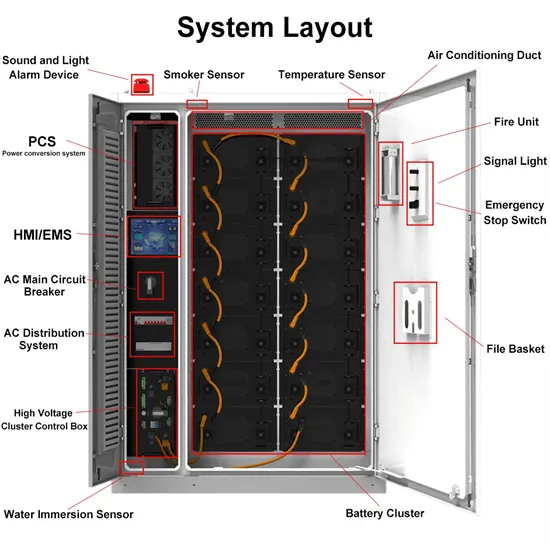

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.