Battery storage tax credit opportunities and development challenges

View information about tax credit opportunities and development challenges for battery storage.

Get Price

SALT and Battery: Taxes on Energy Storage | Tax Notes

The IRA expanded the investment tax credit by eliminating the requirement that a storage system be charged by solar and including stand-alone energy storage systems placed

Get Price

The State of Play for Energy Storage Tax Credits – Publications

Energy storage was one of the major beneficiaries of the IRA''s new rules on both the deployment and manufacturing sides. The IRA enacted the long-sought investment tax

Get Price

US'' tax credit incentives for standalone energy storage begin new

Standout among those measures is the availability of an investment tax credit (ITC) for investment in renewable energy projects being extended to include standalone energy

Get Price

Should You Lease Your Land for an Energy Storage Project

An increasing number of solar developers are now also developing storage projects, and several "pure-play" storage developers have launched. For a landowner, this offers an exciting new

Get Price

Domestic content bonus credit guidance: What''s

Additionally, solar + storage projects must now qualify for the domestic content bonus credit separately for each technology (solar and

Get Price

Battery Storage Land Lease Requirements & Rates 2024

The Inflation Reduction Act (IRA) introduced significant commercial solar tax credits and incentives for clean energy technologies,

Get Price

Clean Electricity Investment Credit

The Clean Electricity Investment Credit is a credit available under the investment tax credit businesses and other entities that invest in a qualified clean or renewable energy facility or

Get Price

Inflation Reduction Act Creates New Tax Credit

The base ITC rate for energy storage projects is 6% and the bonus rate is 30%. The bonus rate is available if the project is under 1MW of

Get Price

IRS Updates On Elective Safe Harbor Under IRA

Notice 2025-08 introduces the First Updated Elective Safe Harbor, providing new tables for solar photovoltaic, land-based wind, and battery

Get Price

SALT and Battery: Taxes on Energy Storage

In this installment of Andersen''s Sodium Podium, the authors discuss the differing property tax and sales tax considerations regarding battery energy storage systems and

Get Price

Renewable Electricity Production Tax Credit Information

The renewable electricity production tax credit (PTC) is a per kilowatt-hour (kWh) federal tax credit included under Section 45 of the U.S.

Get Price

Inflation Reduction Act: Tax Credits Available for

Beginning January 1, 2023, solar projects with a capacity of less than 5 megawatts alternating current and located in certain "low-income

Get Price

Inflation Reduction Act Creates New Tax Credit

On Aug. 16, 2022, President Joe Biden signed into law the Inflation Reduction Act of 2022 (IRA), which includes new and revised tax

Get Price

What is the tax rate for energy storage projects? | NenPower

The approach to project financing can dramatically influence the effective tax rate for energy storage projects. Different financing structures, such as leasing, tax equity

Get Price

US'' tax credit incentives for standalone energy

Standout among those measures is the availability of an investment tax credit (ITC) for investment in renewable energy projects being extended to

Get Price

Federal Solar Tax Credits for Businesses

It reduces the federal income tax liability and is adjusted annually for inflation.4 Generally, project owners cannot claim both the ITC and the PTC for the same property, although they could

Get Price

The State of Play for Energy Storage Tax Credits –

Energy storage was one of the major beneficiaries of the IRA''s new rules on both the deployment and manufacturing sides. The IRA enacted the

Get Price

Inflation Reduction Act Creates New Tax Credit

The base ITC rate for energy storage projects is 6% and the bonus rate is 30%. The bonus rate is available if the project is under 1MW of energy storage capacity or if it meets

Get Price

What the budget bill means for energy storage tax credit eligibility

Storage projects that start construction before 2033 will remain eligible for both the ITC and PTC. Those beginning in 2025 can receive an ITC of up to 50% under 48E if domestic

Get Price

Tax-Exempt Entities and the Investment Tax Credit (§ 48 and

• For projects beginning construction on or after Jan. 29, 2023 or where the maximum net output is 1 MW or greater, the base tax credit is 6% of the taxpayer''s basis in the energy property or

Get Price

What the budget bill means for energy storage tax

Storage projects that start construction before 2033 will remain eligible for both the ITC and PTC. Those beginning in 2025 can receive an

Get Price

Inflation Reduction Act: Tax Credits Available for Utility-Scale

Beginning January 1, 2023, solar projects with a capacity of less than 5 megawatts alternating current and located in certain "low-income communities" (as defined in the IRA) are

Get Price

Ohio Passes Expansive Law to Promote Energy

The legislation establishes a "mercantile customer self-power system" to enable extensive behind-the-meter generation and/or storage

Get Price

What is the tax rate for energy storage power station income?

The tax rate applicable to income generated by energy storage power stations varies based on several factors including the jurisdiction, the nature of the business entity, and

Get Price

Battery Energy Storage Tax Credits in 2024 | Alsym

Do Storage Batteries Qualify for Solar Tax Credits? Yes, standalone battery storage now qualifies for the 30% Residential Clean

Get Price

6 FAQs about [What is the tax rate for power storage projects ]

What is the ITC rate for energy storage projects?

Energy storage installations that begin construction after Dec. 31, 2024, will be entitled to credits under the technology-neutral ITC under new Section 48E (discussed below). The base ITC rate for energy storage projects is 6% and the bonus rate is 30%.

What is the base tax credit for energy projects?

• For projects beginning construction on or after Jan. 29, 2023 or where the maximum net output is 1 MW or greater, the base tax credit is 6% of the taxpayer’s basis in the energy property or qualified facility (or energy storage technology).

What tax credits are available for utility-scale solar and energy storage projects?

Below is a general summary of the tax credits of the IRA available for utility-scale solar and energy storage projects. The IRA extends the current framework of the ITC for solar projects that begin construction prior to January 1, 2025, but creates a new base credit and increased credit structure.

Will the inflation Reduction Act affect energy storage projects?

Image: President Biden via Twitter. The Inflation Reduction Act’s incentives for energy storage projects in the US came into effect on 1 January 2023. Standout among those measures is the availability of an investment tax credit (ITC) for investment in renewable energy projects being extended to include standalone energy storage facilities.

How has the energy storage industry progressed in 2024 & 2025?

The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income tax benefits in the form of tax credits enacted under the Inflation Reduction Act of 2022 (IRA).

Are IRA tax benefits a viable option for energy storage facilities?

While the vitality of the IRA tax benefits in their current form is currently subject to uncertainty given the results of the 2024 federal general election, the existing market practice for financing energy storage facilities since the IRA’s passage continues to evolve in reaction to the act’s new requirements and opportunities.

More related information

-

Zimbabwe s energy storage power export tax rate

Zimbabwe s energy storage power export tax rate

-

Tax rate for portable energy storage power supply

Tax rate for portable energy storage power supply

-

What is the price of photovoltaic power generation and energy storage in Barbados

What is the price of photovoltaic power generation and energy storage in Barbados

-

What are the wind power projects for communication base stations in Sao Tome and Principe

What are the wind power projects for communication base stations in Sao Tome and Principe

-

What are the energy storage container power stations in Namibia

What are the energy storage container power stations in Namibia

-

What does it mean for energy storage projects to be regulated

What does it mean for energy storage projects to be regulated

-

What is the price of lithium energy storage power supply in Bahrain

What is the price of lithium energy storage power supply in Bahrain

-

What are the small energy storage power stations in New Zealand

What are the small energy storage power stations in New Zealand

Commercial & Industrial Solar Storage Market Growth

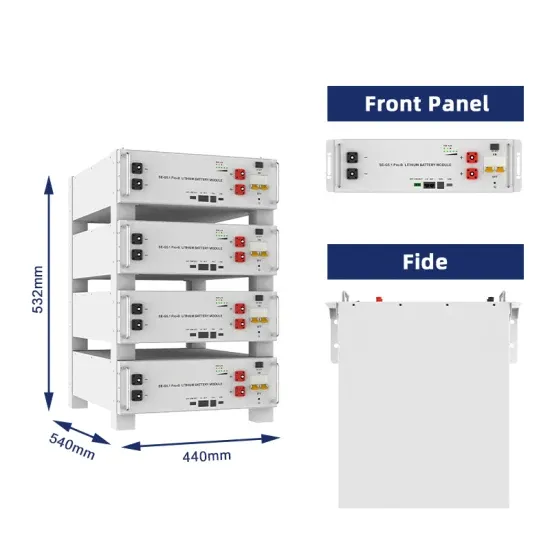

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.