VOLTA ENERGY TECHNOLOGIES | Technically, the

Volta identifies and invests in battery and energy storage technology, including integration hardware and software, after performing deep diligence with the

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S. News

Investors interested in grid-scale storage with low risk may want to consider this utility stock instead of more direct and volatile plays on lithium and battery technology.

Get Price

Investor Presentation

Recurrent Energy achieved the final closing of BlackRock''s $500 million investment, supporting its strategic transition from a pure developer to a developer plus long

Get Price

Photovoltaic Energy Storage Financial Model: A Practical

Photovoltaic Energy Storage Financial Model: A Practical Guide for Investors Who Needs This Guide and Why? If you''ve ever wondered how solar panels and batteries translate to dollar

Get Price

What are the investment models for energy storage projects?

This exploration begins with an in-depth analysis of the various investment strategies applicable to energy storage, progressing through different financial mechanisms,

Get Price

Global Leading Renewable & Green Energy Company

ReNew(NASDAQ: RNW),a global renewable company offering clean & green energy with a portfolio of 17.4 GW including Wind, Solar, Hybrid & Hydro Power.

Get Price

Corporate Profile | Canadian Solar Inc.

Founded in 2001 and headquartered in Kitchener, Ontario, the Company is a leading manufacturer of solar photovoltaic modules; provider of solar energy and battery energy

Get Price

Financial Investment Valuation Models for Photovoltaic and Energy

Using the Web of Science (WoS) and Scopus databases, a scientometric analysis was carried out to understand the methods that have been used in the financial appraisal of

Get Price

pv magazine International – News from the

News from the photovoltaic and storage industry: market trends, technological advancements, expert commentary, and more.

Get Price

Photovoltaic energy storage investment analysis

Taking into account the operational life loss of energy storage and aiming at the minimum operating income of energy storage investment, the fluctuation relationship and constraint

Get Price

How to finance battery energy storage | World

Battery energy storage systems can address the challenge of intermittent renewable energy. But innovative financial models are needed to

Get Price

Best Practices for Operation and Maintenance of

National Renewable Energy Laboratory, Sandia National Laboratory, SunSpec Alliance, and the SunShot National Laboratory Multiyear Partnership (SuNLaMP) PV O&M Best Practices

Get Price

Investment Models for Energy Storage Projects: Which One

If you''re a factory owner sweating over electricity bills, an investor hunting for the next green energy gem, or a project manager trying to decode terms like "virtual power plants,"

Get Price

Subsidy Policies and Economic Analysis of

In the context of China''s new power system, various regions have implemented policies mandating the integration of new energy sources with

Get Price

Top 10 Solar Developers in the World | PF Nexus

With costs continuing to fall and supportive policies expanding, solar energy is poised to play an increasingly central role in the global renewable energy transition.

Get Price

Renewable Energy

Evaluate Performance of Grid-Forming Battery Energy Storage Systems in Solar PV Plants Evaluate the performance of a grid-forming (GFM) battery energy storage system (BESS) in

Get Price

Top 19 Energy Storage Investors in the US

With federal incentives and increasing investments, the sector is poised for growth, targeting not only commercial applications but also residential energy savings, making clean energy more

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S.

Investors interested in grid-scale storage with low risk may want to consider this utility stock instead of more direct and volatile plays on lithium

Get Price

Top 10 Energy Storage Investors in North America | PF Nexus

Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get Price

Advancements in solar technology, markets, and investments

This paper provides a review of the significant advances made by the solar energy sector over the past decade, as well as the challenges that the sector currently faces, with

Get Price

Financial Investment Valuation Models for

Using the Web of Science (WoS) and Scopus databases, a scientometric analysis was carried out to understand the methods that have

Get Price

Business Models and Profitability of Energy Storage

Our goal is to give an overview of the profitability of business models for energy storage, showing which business model performed by a certain technology has been

Get Price

Solar (PV) Power Plant Financial Model

Solar (PV) Power Plant – Project Finance Model Introducing our Solar Project Finance Model – a comprehensive tool for optimizing investments in solar

Get Price

Canadian Solar – Global

Under Dr. Qu''s leadership, we have grown into one of the world''s largest solar photovoltaic products and energy solutions providers, as well as one of the

Get Price

Zinc-Iodide Battery Tech Disrupts $293B Energy Storage Market

3 days ago· Renewable energy and stationary storage at scale: Joley Michaelson''s woman-owned public benefit corporation deploys zinc-iodide flow batteries and microgrids.

Get Price

What are the investment models for energy storage

This exploration begins with an in-depth analysis of the various investment strategies applicable to energy storage, progressing through

Get Price

Energy Storage Financing: Project and Portfolio Valuation

The Project Economic Model—also known as the Project Financial Model—provides a structured framework for the integrated economic valuation of an energy storage project.

Get Price

6 FAQs about [Photovoltaic energy storage model investors]

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

Should energy storage project developers develop a portfolio of assets?

12 PORTFOLIO VALUATION Developing a portfolio of assets can be seen as the inevitable evolution for energy storage project developers and private equity investors who are interested in leveraging their knowledge of the technology, expertise in project development, and access to capital.

What is energy storage project valuation methodology?

Energy storage project valuation methodology is ower sector projects through evaluating various revenue and cost typical of p assumptions in a project economic model.

How do you value energy storage projects?

The central tool for valuing an energy storage project is the project valuation model. Many still use simple Excel models to evaluate projects, but to capture the opportunities in the power market, it is increasing required to utilize something with far greater granularity in time and manage multiple aspects of the hardware.

Are energy storage projects different than power industry project finance?

Most groups involved with project development usually agree that energy storage projects are not necessarily different than a typical power industry project finance transaction, especially with regards to risk allocation.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

More related information

-

Photovoltaic energy storage power generation profit model

Photovoltaic energy storage power generation profit model

-

Huawei Chad photovoltaic energy storage model

Huawei Chad photovoltaic energy storage model

-

San Marino photovoltaic energy storage charging model

San Marino photovoltaic energy storage charging model

-

Energy storage power photovoltaic power station

Energy storage power photovoltaic power station

-

What are the advantages of photovoltaic communication base station energy storage system

What are the advantages of photovoltaic communication base station energy storage system

-

100MW photovoltaic energy storage cost in 2025

100MW photovoltaic energy storage cost in 2025

-

Energy storage base station uses photovoltaic power generation or photovoltaic power generation

Energy storage base station uses photovoltaic power generation or photovoltaic power generation

-

Photovoltaic energy storage cabinet battery to lithium battery

Photovoltaic energy storage cabinet battery to lithium battery

Commercial & Industrial Solar Storage Market Growth

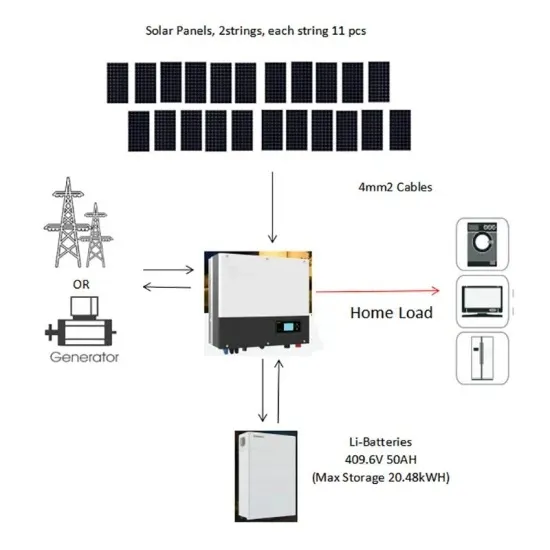

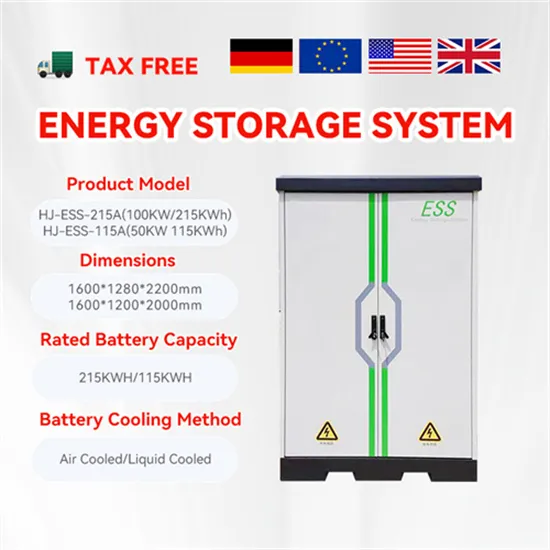

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.