Project Financing and Energy Storage: Risks and Revenue

Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to finance the construction and

Get Price

Treasury releases final rules for clean energy

The U.S. Department of Treasury has released final rules for the Section 48 Energy Credit, commonly known as the Investment Tax Credit

Get Price

Project Financing and Energy Storage: Risks and

The United States and global energy storage markets have experienced rapid growth that is expected to continue. An estimated 387

Get Price

Battery Storage Land Lease Requirements & Rates 2024

Land requirements are a significant factor in the development of BESS projects. Understanding the land needs, lease rates, and other related

Get Price

Energy Storage Financing: Project and Portfolio Valuation

This study investigates the issues and challenges surrounding energy storage project and portfolio valuation and provide insights into improving visibility into the process for developers,

Get Price

USAID Energy Storage Decision Guide for Policymakers

Energy storage is poised to become a major component of power systems of the future. Energy storage has been instrumental for the development of affordable and reliable electricity supply

Get Price

Energy Storage 101

Planning describes the process for identifying grid needs, translating such needs into technical requirements, and analyzing the cost-effectiveness and viability of energy

Get Price

Ten things every developer needs to know about battery energy storage

Our battery storage experts examine the challenges facing developers when planning, designing and building battery energy storage systems (BESS) projects.

Get Price

Financing Battery Storage Systems: Options and

Recently, Peak Power conducted an energy storage finance webinar that focused on strategies available for financing battery storage

Get Price

FACT SHEET: Four Ways the Inflation Reduction Act s Tax

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide a 30 percent credit for qualifying investments in wind, solar, energy storage, and other

Get Price

Federal Solar Tax Credits for Businesses

Disclaimer This resource from the U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) provides an overview of the federal investment and production tax credits for

Get Price

Inflation Reduction Act Creates New Tax Credit

On Aug. 16, 2022, President Joe Biden signed into law the Inflation Reduction Act of 2022 (IRA), which includes new and revised tax

Get Price

Project Financing and Energy Storage: Risks and

Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to

Get Price

Final Regulations Clarify the Investment Tax Credit Rules

Section 48 of the Internal Revenue Code allows taxpayers generally to claim a 30% investment tax credit ("ITC") for certain types of

Get Price

Strategic Guide to Deploying Energy Storage in NYC

The storage industry anticipates this to be passed into law in 2022, and that it will apply to projects that achieved commercial operation after December 31, 2020, reducing the risks and

Get Price

ENERGY STORAGE PROJECTS

DOE''s recently published Long Duration Energy Storage (LDES) Liftoff Report found that the U.S. grid may need between 225 and 460 gigawatts of LDES by

Get Price

NYCEDC Advances Green Economy Action Plan with

NYCIDA helps to lower the cost of capital investment through discretionary tax benefits. The IDA has supported approximately 254MW of

Get Price

Energy Storage 101

Planning describes the process for identifying grid needs, translating such needs into technical requirements, and analyzing the cost

Get Price

Energy Storage Feasibility and Lifecycle Cost Assessment

To evaluate the technical, economic, and operational feasibility of implementing energy storage systems while assessing their lifecycle costs. This analysis identifies optimal storage

Get Price

What investment is needed for energy storage?

To determine the investment required for energy storage, several core factors must be considered: 1. Initial capital outlay, 2. Operational costs,

Get Price

Basic Requirements for Energy Storage Projects: Key Insights for

Ever wondered why energy storage projects are suddenly the "cool kids" of the renewable energy playground? From Tesla''s Megapacks to California''s record-breaking

Get Price

Battery Storage Land Lease Requirements & Rates 2024

Land requirements are a significant factor in the development of BESS projects. Understanding the land needs, lease rates, and other related considerations is essential for

Get Price

Investment Insights into Energy Storage Power Stations: Cost

12 hours ago· Understanding the energy storage cost breakdown is key to evaluating feasibility and long-term ROI. This article explores core cost components and the major factors shaping

Get Price

Energy Outlook 2025: Energy Storage

Also of interest to investors and developers of storage projects, IRENA has published the Electricity Storage Valuation Framework report,

Get Price

ENERGY STORAGE PROJECTS

DOE''s recently published Long Duration Energy Storage (LDES) Liftoff Report found that the U.S. grid may need between 225 and 460 gigawatts of LDES by 2050, requiring $330 billion in

Get Price

IRA sets the stage for US energy storage to thrive

The Inflation Reduction Act (IRA) signed into law in August significantly improves the economics for large-scale battery storage projects in

Get Price

What investment is needed for energy storage? | NenPower

To determine the investment required for energy storage, several core factors must be considered: 1. Initial capital outlay, 2. Operational costs, 3. Technological advancements, 4.

Get Price

IRA sets the stage for US energy storage to thrive

The Inflation Reduction Act (IRA) signed into law in August significantly improves the economics for large-scale battery storage projects in the U.S.

Get Price

U.S. Grid Energy Storage Factsheet

Electrical Energy Storage (EES) refers to systems that store electricity in a form that can be converted back into electrical energy when needed. 1 Batteries

Get Price

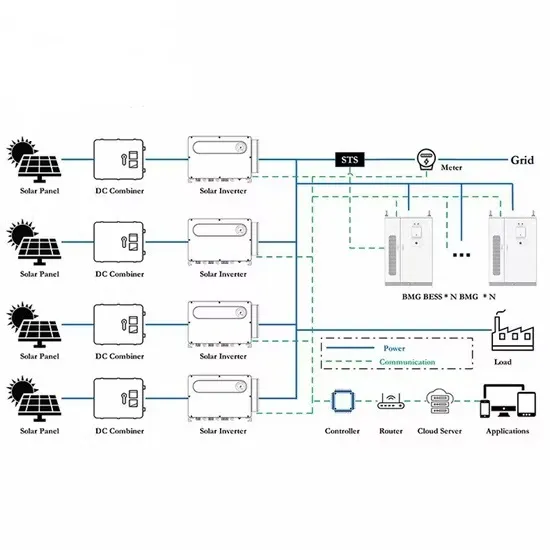

What are the technical requirements for energy storage projects?

For project developers, understanding a storage system''s energy capacity is essential as it directly correlates with the needs of the grid, consumer demand, and the type of

Get Price

6 FAQs about [Energy Storage Project Investment Requirements]

What are energy storage specific project requirements?

Project Specific Requirements: Elements for developing energy storage specific project requirements include ownership of the storage asset, energy storage system (ESS) performance, communication and control system requirements, site requirements and availability, local constraints, and safety requirements.

Does project finance apply to energy storage projects?

The general principles of project finance that apply to the financing of solar and wind projects also apply to energy storage projects. Since the majority of solar projects currently under construction include a storage system, lenders in the project finance markets are willing to finance the construction and cashflows of an energy storage project.

Should energy storage projects be developed?

However, energy storage project development does bring with it a greater number of moving parts to the projects, so developers must consider storage’s unique technology, policy and regulatory mandates, and market issues—as they exist now, and as the market continues to evolve.

Are energy storage systems a good investment?

This is understandable as energy storage technologies possess a number of inter-related cost, performance, and operating characteristics that and impart feed-back to impacts to the other project aspects. However, this complexity is the heart of the value potential for energy storage systems.

Should energy storage project developers develop a portfolio of assets?

12 PORTFOLIO VALUATION Developing a portfolio of assets can be seen as the inevitable evolution for energy storage project developers and private equity investors who are interested in leveraging their knowledge of the technology, expertise in project development, and access to capital.

What are energy storage needs in the power sector?

For many decades, energy storage needs in the power sector primarily revolved around the use of pumped hydro systems at the utility scale level, and lead acid batteries for either UPS systems at power facilities and substations or supporting off-grid applications.

More related information

-

Israel Energy Investment Energy Storage Project

Israel Energy Investment Energy Storage Project

-

How much investment is needed for Kuwait s energy storage project

How much investment is needed for Kuwait s energy storage project

-

How much is the total investment in Iceland s energy storage project

How much is the total investment in Iceland s energy storage project

-

Gambia photovoltaic energy storage investment project

Gambia photovoltaic energy storage investment project

-

The world s largest energy storage investment project

The world s largest energy storage investment project

-

Huawei s energy storage project investment model

Huawei s energy storage project investment model

-

German Energy Investment Wind Solar and Storage Project

German Energy Investment Wind Solar and Storage Project

-

New energy storage project investment

New energy storage project investment

Commercial & Industrial Solar Storage Market Growth

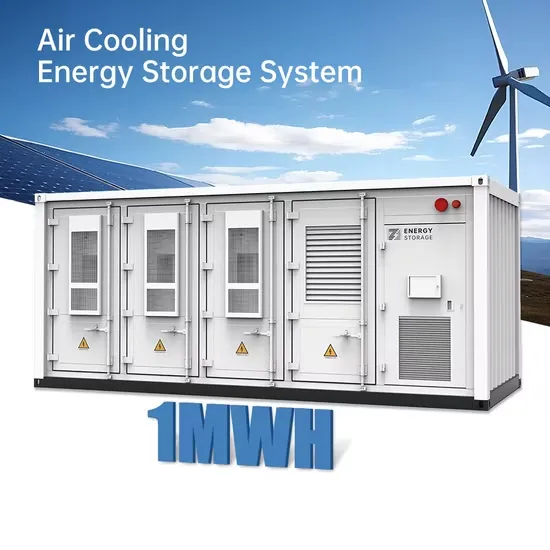

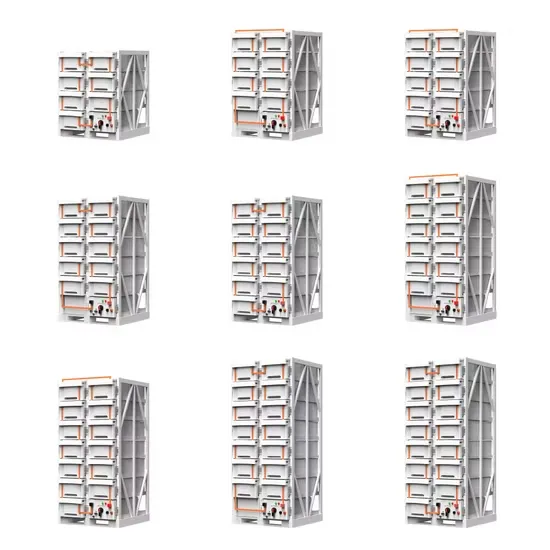

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

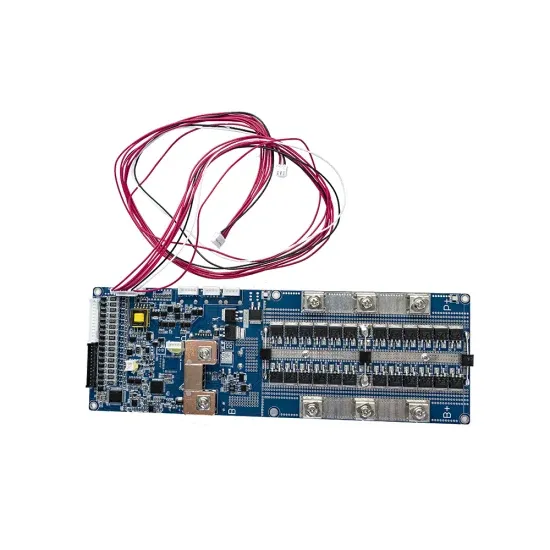

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.