Evaluating energy storage tech revenue potential | McKinsey

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of

Get Price

Evaluating energy storage tech revenue potential

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often

Get Price

Unlocking Profit Potential: 7 Revenue Streams for Modern Energy Storage

But here''s the kicker – 63% of developers still rely on single revenue streams. That''s like putting all your eggs in one battery pack! The volatility of energy markets and shifting policy

Get Price

How is the revenue from energy storage projects? | NenPower

Energy storage projects generate revenue through multiple avenues, including but not limited to, 1) ancillary services, 2) energy arbitrage, 3) capacity payments, and 4)

Get Price

In-depth explainer on energy storage revenue and effects on

The following article provides a high-level overview of the revenue models for non-residential energy storage projects and how financing parties evaluate the various sources of

Get Price

Battery Energy Storage Systems Report

This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

Get Price

Energy Storage Market Size, Growth, Share

The Energy Storage Market is expected to reach USD 295 billion in 2025 and grow at a CAGR of 9.53% to reach USD 465 billion by 2030.

Get Price

Business Models and Profitability of Energy Storage

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream

Get Price

BESS STORAGE paper

The significant shift towards sustainable energy solutions has created the foundation for BESS to thrive, with the prospect of substantial growth in investment over the

Get Price

Energy Storage Grand Challenge Energy Storage Market

This report, supported by the U.S. Department of Energy''s Energy Storage Grand Challenge, summarizes current status and market projections for the global deployment of selected

Get Price

Project Financing and Energy Storage: Risks and Revenue

These projects will have long-term predictable revenue streams. In addition, lenders may be willing to finance merchant cashflows, but with less leverage and subject to detailed

Get Price

Energy Storage Financing: Project and Portfolio Valuation

Revenue for the energy storage project will either be expressed as a contracted revenue stream from a PPA (Power Purchase Agreement), derived from merchant activity by the facility, or

Get Price

Battery Energy Storage Systems'' Revenue Based on Arbitrage Is

Related Content: What Investors Want to Know: Project-Financed Battery Energy Storage Systems Fitch Ratings-London-20 June 2023: Battery energy storage systems

Get Price

Maximizing Revenue Streams for Storage Projects

Storage economics rely on surplus renewable generation conditions, where high storage revenues will generally correspond to low

Get Price

How is the revenue from energy storage projects?

Energy storage projects generate revenue through multiple avenues, including but not limited to, 1) ancillary services, 2) energy arbitrage,

Get Price

Unlocking Profit Potential: 7 Revenue Streams for Modern Energy Storage

Why Energy Storage Projects Need Diverse Income Sources You know, the energy storage sector''s projected to hit $86 billion by 2030 according to the 2024 Global Market Insights

Get Price

Battery storage revenues and routes to market

To start with perhaps the simplest revenue source available – revenues available from being awarded capacity market contracts. In this mechanism BESS projects can bid into

Get Price

Making project finance work for battery energy storage projects

Why securing project finance for energy storage projects is challenging It has traditionally been difficult to secure project finance for energy storage for two key reasons. Firstly, the nascent

Get Price

Project Financing and Energy Storage: Risks and

These projects will have long-term predictable revenue streams. In addition, lenders may be willing to finance merchant cashflows, but with less

Get Price

Unlocking Profit Potential: 7 Revenue Streams for Modern Energy

But here''s the kicker – 63% of developers still rely on single revenue streams. That''s like putting all your eggs in one battery pack! The volatility of energy markets and shifting policy

Get Price

Maximizing Revenue Streams for Storage Projects During the Energy

Storage economics rely on surplus renewable generation conditions, where high storage revenues will generally correspond to low renewable revenues. A flood of early-stage

Get Price

In-depth explainer on energy storage revenue and effects on

To start with perhaps the simplest revenue source available – revenues available from being awarded capacity market contracts. In this

Get Price

Battery Energy Storage Key Drivers of Growth

The fact that a battery storage project market developed without subsidy support meant that its business case is predicated on a mix of revenue streams. The optimal mix is

Get Price

Energy Storage Excel Financial Model

The Energy Storage Excel Financial Model serves as a critical tool for assessing the financial viability of energy storage projects. This model aids

Get Price

Unlocking Energy Storage: Revenue streams and regulations

Huawei has also partnered with Hungarian firms to develop one of Central Europe''s largest solar energy storage units in Szolnok, expected to double Hungary''s current energy storage

Get Price

Battery Storage Funding Critical to Europe''s Energy Transition

Battery Storage Funding Critical to Europe''s Energy Transition This KBRA Europe (KBRA) report examines current funding methods for battery storage in mainland Europe and the UK, as well

Get Price

Tesla''s 2024 energy storage revenue surpasses $10 billion

Records are tumbling for Tesla''s battery energy storage business with revenues growing 67% and deployments surging 114% year-on-year.

Get Price

Unlocking Energy Storage: Revenue streams and regulations

By 2030, the global energy storage market is projected to grow at a compound annual growth rate (CAGR) of 21%, with installed capacity expected to reach 137 GW (442 GWh). The rising

Get Price

A Look into the Performance of CAISO''s Two Largest

As both phases of the project remain offline, Vistra is planning to nearly double the project''s capacity by adding another 350 MW of lithium-ion storage as

Get Price

The Economic Impact of Renewable Energy and Energy

to provide some perspective from some of the residents of those areas. Funds flowing into counties from re-newable energy projects typically consist of two major forms: increased tax

Get Price

6 FAQs about [Energy storage project revenue sources]

What economic inputs are included in the energy storage model?

The economic inputs into the model will include both the revenue and costs for the project. Revenue for the energy storage project will either be expressed as a contracted revenue stream from a PPA (Power Purchase Agreement), derived from merchant activity by the facility, or some combination thereof.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Why do energy storage projects need project financing?

The rapid growth in the energy storage market is similarly driving demand for project financing. The general principles of project finance that apply to the financing of solar and wind projects also apply to energy storage projects.

What is the source of revenue for many power projects?

For many power projects, a single power purchase agreement provides the source of all revenue for the project. Fixed-price contracts allow a project to generate a relatively predictable and stable amount of revenue, subject to the project meeting technical operating assumptions.

How do you value energy storage projects?

The central tool for valuing an energy storage project is the project valuation model. Many still use simple Excel models to evaluate projects, but to capture the opportunities in the power market, it is increasing required to utilize something with far greater granularity in time and manage multiple aspects of the hardware.

Should energy storage projects be developed?

However, energy storage project development does bring with it a greater number of moving parts to the projects, so developers must consider storage’s unique technology, policy and regulatory mandates, and market issues—as they exist now, and as the market continues to evolve.

More related information

-

How much revenue does the Vanuatu energy storage project generate

How much revenue does the Vanuatu energy storage project generate

-

Guangqian Energy Storage Power Station Project Revenue

Guangqian Energy Storage Power Station Project Revenue

-

What is a photovoltaic independent energy storage project

What is a photovoltaic independent energy storage project

-

Czech energy storage peak shaving project

Czech energy storage peak shaving project

-

South African Energy Storage Project Procurement

South African Energy Storage Project Procurement

-

Tonga Group Energy Storage Integration Project

Tonga Group Energy Storage Integration Project

-

Somaliland Energy Storage Photovoltaic Project

Somaliland Energy Storage Photovoltaic Project

-

East Timor Energy Storage Photovoltaic Power Generation Project

East Timor Energy Storage Photovoltaic Power Generation Project

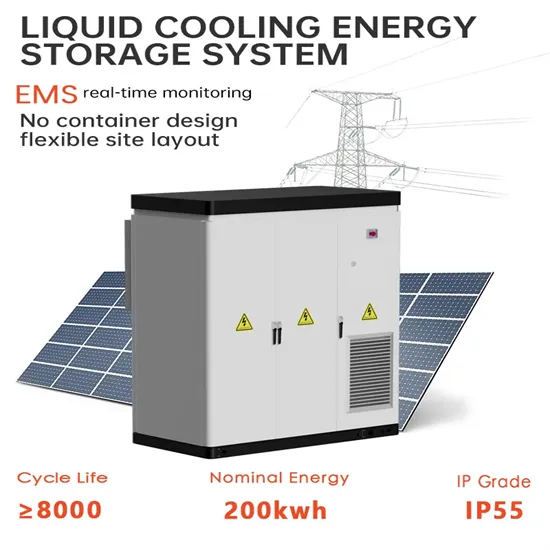

Commercial & Industrial Solar Storage Market Growth

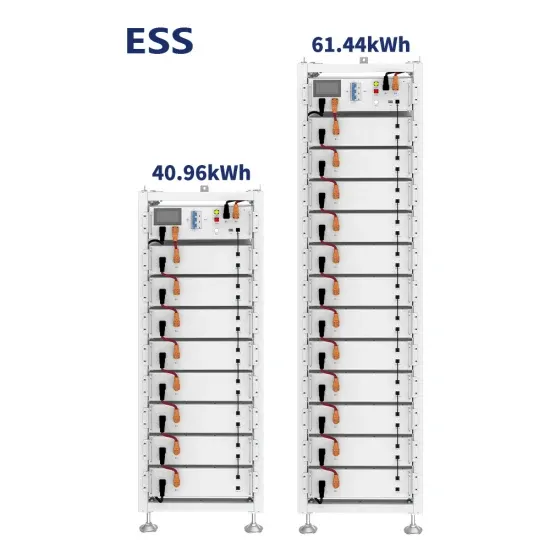

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.