Limes sells 287 MW renewable portfolio | Switchgear Magazine

Italy, Milan: Limes Renewable Energy, a global developer specialising in solar, wind, and battery energy storage systems, has finalised the sale of a 287 MW renewable

Get Price

Italy''s Energy Storage Charging Stations: Powering a Renewable

Italy''s Superbonus 110% scheme now covers storage-integrated charging stations, while the EU''s Fit for 55 program mandates 50kW+ charging sites to have onsite storage by 2027.

Get Price

Standalone Station-HyperStrong

Standalone Station With its market-oriented operation, the standalone energy storage station enables participation in power spot market transactions and

Get Price

Galileo sheds 98-MW fully permitted BESS project in

Pan-European renewable energy developer and investor Galileo has offloaded a 98-MW battery storage project in Southern Italy to an

Get Price

Understanding the Italian Energy Storage Power Station

When news broke about the Italian energy storage power station accident in 2022, it sent shockwaves through the renewable energy sector. Imagine this: a cutting-edge facility

Get Price

Italy''s First Energy Storage Power Station: Charging Toward a

When Italy flipped the switch on its first grid-scale energy storage facility in 2023 near Milan, it wasn''t just local engineers doing cartwheels. This 35MW lithium-ion battery system - about the

Get Price

EU Approves €17.7 Billion for Italy''s Renewable

By implementing large-scale electricity storage facilities, the Italian scheme aspires to reduce energy reliance on fossil fuels and foster a resilient

Get Price

Electricity explained Energy storage for electricity generation

Energy storage for electricity generation An energy storage system (ESS) for electricity generation uses electricity (or some other energy source, such as solar-thermal energy) to charge an

Get Price

Recurrent secures financing for Italian solar-plus-storage project

Independent power producer Recurrent Energy has secured €61.5 million (US$71.4 million) in financing for its Italian renewables portfolio.

Get Price

List of the 150 largest independent power producers in

Our exclusive list of the largest independent power producers (IPPs) in Europe. The list includes contact details and many more information

Get Price

Italian Energy Storage Power Station Subsidies: What You Need

Italy''s Storage Subsidy Landscape: Not Just "Free Money" Let''s face it: energy storage power stations aren''t cheap. But here''s the good news—Italy''s government is throwing financial

Get Price

Analysis of Independent Energy Storage Business Model Based

As the hottest electric energy storage technology at present, lithium-ion batteries have a good application prospect, and as an independent energy storage power station, its business model

Get Price

Limes sells 287MW Italian renewables portflio

Italian renewable energy developer Limes has sold a 287MW portfolio of solar PV and wind power projects to an unnamed IPP.

Get Price

Italian fire energy storage power station

Are battery energy storage systems a good idea in Italy? Storage systems can therefore maximize clean electricity generation and are indispensable for achieving decarbonization goals, thus

Get Price

Zelestra and BKW sign innovative long-term tolling agreement

2 days ago· The innovative tolling agreement signed between Zelestra and BKW enables the delivery of one of Europe''s largest battery energy storage systems (BESS), of up to 2 GWh, in

Get Price

Top 10 Energy Storage Companies in Italy | PF Nexus

This article highlights the most prominent developers, EPCs, and solution providers in the Italian energy storage market, presenting the top 10 companies. These actors are

Get Price

Recurrent secures financing for Italian solar-plus

Independent power producer Recurrent Energy has secured €61.5 million (US$71.4 million) in financing for its Italian renewables portfolio.

Get Price

EU Approves €17.7 Billion for Italy''s Renewable Energy Storage

By implementing large-scale electricity storage facilities, the Italian scheme aspires to reduce energy reliance on fossil fuels and foster a resilient grid, prepared to handle

Get Price

Italy''s Energy Storage Revolution: Powering 2025 and Beyond

These developments suggest Italy''s storage sector might not just meet its 2025 targets - it could potentially exceed them. The question isn''t whether storage will transform Italy''s energy

Get Price

Powering Up: The Role of Independent Energy Storage in a

Looking Ahead The role of independent energy storage stations will increase proportionately with the growth in renewable energy generation and increasing claims for

Get Price

Italy Energy Storage

As Italy''s energy mix is increasingly composed of variable renewable energy sources, electricity storage will be needed to integrate power generated by renewables into the

Get Price

The Use of Italian Energy Storage Power Stations: Powering a

Behind the scenes, the country is quietly becoming a European leader in energy storage power stations—a critical piece of the renewable energy puzzle. Think of these

Get Price

Construction Begins on China''s First Independent

The Wenshui Energy Storage Power Station project covers approximately 3.75 hectares within the red line area. The station is divided

Get Price

BATTERY ENERGY STORAGE SYSTEMS (BESS) —

Introduction Sustainable energy systems based on fluctuating renewable energy sources require storage technologies for stabilising grids and for shifting renewable production to match

Get Price

GreenGo gets green light for 80 MW of battery storage in Italy

It took two years for the Bologna-based independent power producer (IPP) to secure the approval for two battery energy storage projects in southern Italy. GreenGo plans

Get Price

6 FAQs about [Italian independent energy storage power station]

Does Italy need electricity storage?

As Italy’s energy mix is increasingly composed of variable renewable energy sources, electricity storage will be needed to integrate power generated by renewables into the national grid and make it available when sun and wind energy are not accessible.

Is there a need for energy storage solutions in Italy?

Local industry contacts, as well as U.S. sector firms, have also indicated to Post that there is a need for energy storage solutions in Italy.

Are battery energy storage systems needed in Italy?

Therefore, battery energy storage systems (BESS) are needed in Italy. The Italian market for BESS is growing rapidly and currently amounts to 2.3 GW but it almost exclusively consists of residential scale systems, associated with small scale solar plants, having a capacity of less than 20 kWh.

How will Italy develop utility-scale electricity storage facilities?

To develop utility-scale electricity storage facilities, the Italian Government set up a scheme that was approved by the European Commission at the end of 2023. Italy will promote investments in utility scale electricity storage to reach at least 70 GWh, and worth over Euro 17 bn, in the next ten years.

How will Italy invest in electricity storage?

Italy will promote investments in utility scale electricity storage to reach at least 70 GWh, and worth over Euro 17 bn, in the next ten years. The new storage capacity will be acquired through tenders published by Terna, the manager of Italy’s high voltage grid. The next tender will be released in 2024.

How many storage systems are there in Italy?

More in detail, 311,189 storage systems were present in Italy in mid- 2023, with a total power of 2,329 MW and a maximum capacity of 3,946 MWh. Terna (the high voltage grid operator) also holds systems totaling 60 MW in power and 250 MWh in capacity.

More related information

-

Hybrid energy storage independent frequency regulation power station

Hybrid energy storage independent frequency regulation power station

-

ASEAN s first independent energy storage power station

ASEAN s first independent energy storage power station

-

Andorra Independent Energy Storage Power Station

Andorra Independent Energy Storage Power Station

-

Independent Energy Storage Power Station Application Development Model

Independent Energy Storage Power Station Application Development Model

-

Independent energy storage power station connected to the grid

Independent energy storage power station connected to the grid

-

Independent power station energy storage equipment

Independent power station energy storage equipment

-

Independent energy storage power station equipment

Independent energy storage power station equipment

-

Independent energy storage power station subsidies

Independent energy storage power station subsidies

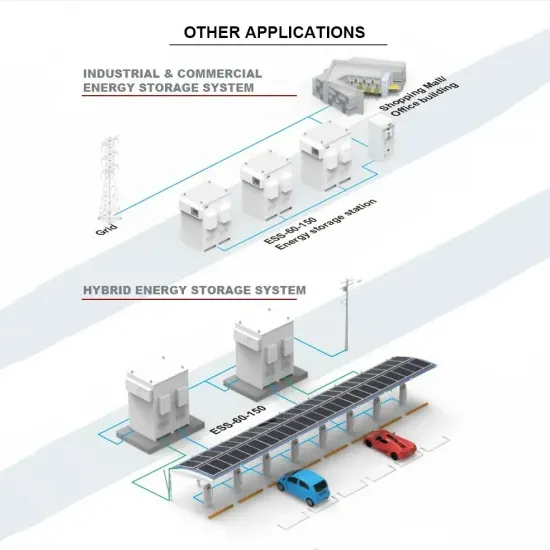

Commercial & Industrial Solar Storage Market Growth

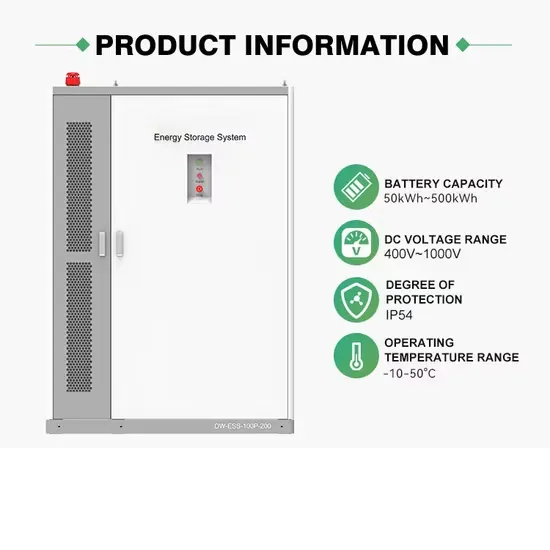

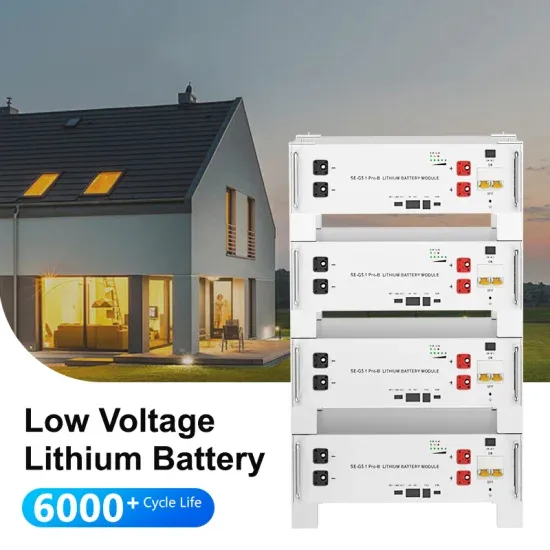

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

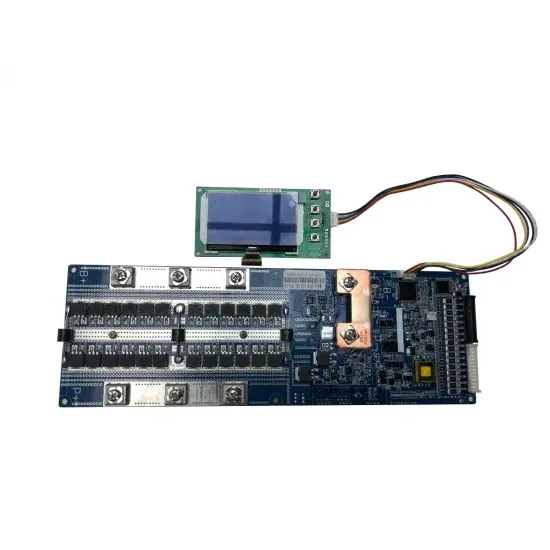

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.