Europe PV Inverter Market Size, Share & Growth Report, 2033

According to the French Ministry of Economy and Finance, the average price of inverters rose by 12% during the first half of 2022, which is impacting project economics and

Get Price

Solar photovoltaics in Europe

The production volume of electricity from solar photovoltaic power in the European Union has been steadily increasing in the last years. In 2024, the EU''s solar PV power

Get Price

Europe Solar Inverters Market

Europe Solar Inverter analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.

Get Price

April 2025 Tariffs | Solar Equipment | Industry Impact

Table: Illustrative price movement for core solar project components (wholesale level) from before April 2025 to after the tariff implementation. The

Get Price

PV Solar Inverters

PVshop offers a complete range of solar inverters for your PV system. The world''s leading solar power inverters for all photovoltaic applications at the best price with worldwide delivery

Get Price

Solar Inverter Prices in 2025: Trends & Cost Breakdown

As the demand for renewable energy surges, solar inverter prices in 2025 continue to evolve, influenced by technological advancements, increased manufacturing, and global

Get Price

Europe Solar Inverter Market Analysis

The Europe Solar Inverter market is undergoing significant growth as solar energy becomes a crucial component of the region''s renewable energy transition.

Get Price

Top 10 Best Inverter Manufacturers in Europe

In this article, we will inform you About the Top 10 best inverter manufacturers in Europe, which include SMA Solar Technology, REFUsol,

Get Price

Top 8 Solar Inverter Manufacturers in Europe (2024)

Based in Switzerland, ABB has a strong presence in the solar inverter manufacturing industry across Europe. The company provides an array of solar inverters that cater to various

Get Price

eu-market-outlook-for-solar-power-2023-2027

SolarPower Europe''s annual EU Market Outlook helps policy stakeholders in delivering solar PV''s immense potential to meet the EU''s 2030 renewable energy targets.

Get Price

pv dex: module price continues to decline in Europe

The price of solar panels in Europe has declined for a sixth month in a row, according to the latest pv dex report.

Get Price

Prices Inverters + Storage Solutions

All prices are net and without transportation. Offer valid while stock lasts. Cancellation fee: 10% of the net value of the bill. Delivery: Incoterms 2020. Please ask for a specific quotation. We will

Get Price

Top 8 Solar Inverter Manufacturers in Europe (2024)

Europe has been a forerunner in the global transition towards renewable energy, especially in harnessing solar power. The pivotal role of solar inverters in

Get Price

Europe Solar Inverters Industry 2025-2033 Analysis: Trends,

Inverter Type: A detailed breakdown of the market share and growth prospects for Central Inverters, String Inverters, and Micro Inverters, analyzing their respective strengths

Get Price

Zaragoza RV Inverters

Advanced RV inverters for Zaragoza, Spain, Southern Europe. Pure sine wave output, MPPT charging, mobile app control, and multi-layer safety protection. Engineered for Continental

Get Price

Top 10 Best Inverter manufactures In China (Update

Explore the top 10 Inverter Manufactures In China for 2024, leading in solar innovation, quality, and efficiency. Find the best partner for

Get Price

Top 10 Best Inverter Manufacturers in Europe

In this article, we will inform you About the Top 10 best inverter manufacturers in Europe, which include SMA Solar Technology, REFUsol, Tycorun, KACO New Energy,

Get Price

Top 8 Solar Inverter Manufacturers in Europe: 2025 Guide

The European solar inverter market is set to grow from USD 2.85 billion in 2024 to USD 3.66 billion by 2029, with a growth rate of 5.06% annually. This growth is driven by government

Get Price

European solar market update 2025

European solar market update 2025 The past year has been dynamic for the European solar industry. While solar remains essential to Europe''s energy

Get Price

Europe Solar Inverters Market

Europe Solar Inverter analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry

Get Price

European PV panel prices rise, inverter prices fall!

Weak demand in the residential and small commercial and industrial (C&I) sectors, as well as ample inventory levels, caused PV inverter prices to fall slightly in April.

Get Price

Southern Europe: Inverters Market and the Impact of COVID-19

This report analyzes the Southern European inverters market and its size, prices, imports, exports, and more. Visit to learn more.

Get Price

Solar Inverter Prices in 2025: Trends & Cost Breakdown

As the demand for renewable energy surges, solar inverter prices in 2025 continue to evolve, influenced by technological advancements,

Get Price

SolarPower Europe on measures to support inverter

Europe boasts more than 82GW of annual inverter production capacity, but EU inverter companies'' market share in the continent is shrinking

Get Price

The weekend read: Europe''s inverted solar ambition

Solar inverters have been designed and made in Europe since Germany kickstarted the industry in 2000. IHS Markit put the European share at around 24% of the world''s inverter

Get Price

Top 8 Solar Inverter Manufacturers in Europe (2024)

Based in Switzerland, ABB has a strong presence in the solar inverter manufacturing industry across Europe. The company provides an array of

Get Price

PV Index – module prices climb as inverters dip

Prices for modules continued their climb in May on strong demand and limited supply, while inverter prices edged down. The PV Purchasing

Get Price

6 FAQs about [Price of inverters produced in Southern Europe]

How big is the European solar inverter market?

The European solar inverter market is set to grow from USD 2.85 billion in 2024 to USD 3.66 billion by 2029, with a growth rate of 5.06% annually. This growth is driven by government incentives, investments in solar energy, and a focus on reducing carbon emissions. Germany is the largest market, followed by the UK and France.

What is the global solar inverter market size?

The Report Offers the Market Size in Value Terms in USD for all the Abovementioned Segments. The Europe Solar Inverter Market size is estimated at USD 2.99 billion in 2025, and is expected to reach USD 3.83 billion by 2030, at a CAGR of 5.06% during the forecast period (2025-2030).

Which countries use the most solar inverters?

Germany is the largest market, followed by the UK and France. Central inverters for large solar projects are expected to dominate, while micro inverters for homes are also growing. Hybrid inverters, which combine solar and battery storage, are gaining popularity as more people seek energy independence.

Who are the key players in the European solar inverters market?

The European solar inverters market is highly fragmented. The key players (in no particular order) in the market include FIMER SpA, Schneider Electric SE, Siemens AG, Mitsubishi Electric Corporation, and General Electric Company, among others. Need More Details on Market Players and Competitors?

Who makes the most solar PV inverters in the world?

In 2023, the global shipment of solar PV inverters reached 536 GWac, with Chinese solar inverter manufacturers responsible for half of these shipments. Companies like Huawei, Sungrow, and Ginlong Solis dominate the top ranks, securing more than 50% of the global market share.

Which inverter companies dominate the global market?

Companies like Huawei, Sungrow, and Ginlong Solis dominate the top ranks, securing more than 50% of the global market share. China’s manufacturing capabilities are backed by massive national investments and cutting-edge technologies, making Chinese inverters highly competitive in terms of performance, reliability, and price.

More related information

-

Southern European Energy Storage Battery Price Factory

Southern European Energy Storage Battery Price Factory

-

Huawei Southern Europe Energy Storage Photovoltaic Panels

Huawei Southern Europe Energy Storage Photovoltaic Panels

-

Southern Europe Battery Station Cabinet Integration System

Southern Europe Battery Station Cabinet Integration System

-

Buy high-power outdoor power supply in Southern Europe

Buy high-power outdoor power supply in Southern Europe

-

Southern Europe inverter output voltage and frequency

Southern Europe inverter output voltage and frequency

-

What is the price of environmentally friendly inverters in Barbados

What is the price of environmentally friendly inverters in Barbados

-

Price of medium-frequency inverters in Mozambique

Price of medium-frequency inverters in Mozambique

-

Which energy storage power supply is better in Southern Europe

Which energy storage power supply is better in Southern Europe

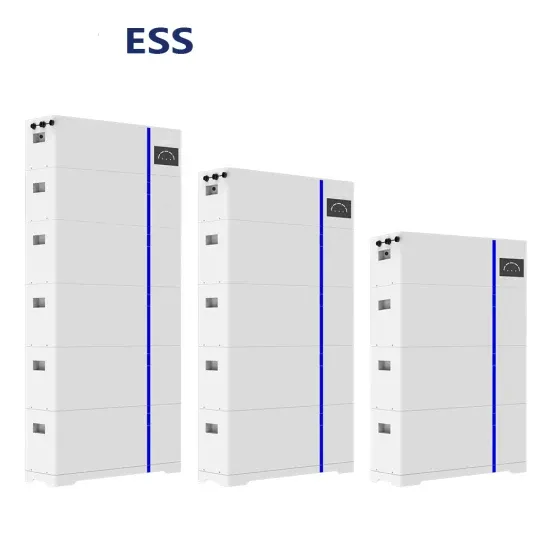

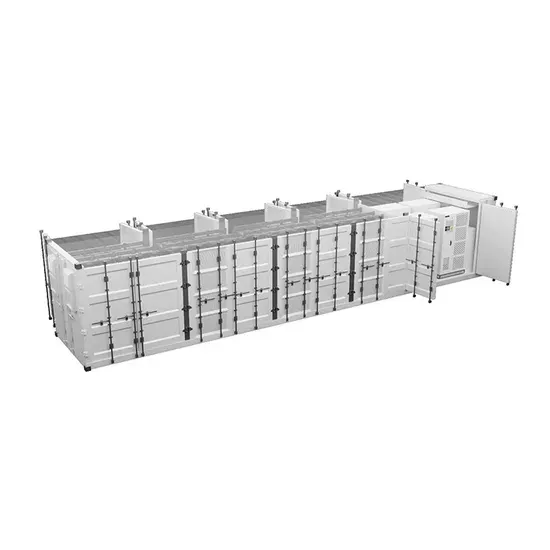

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

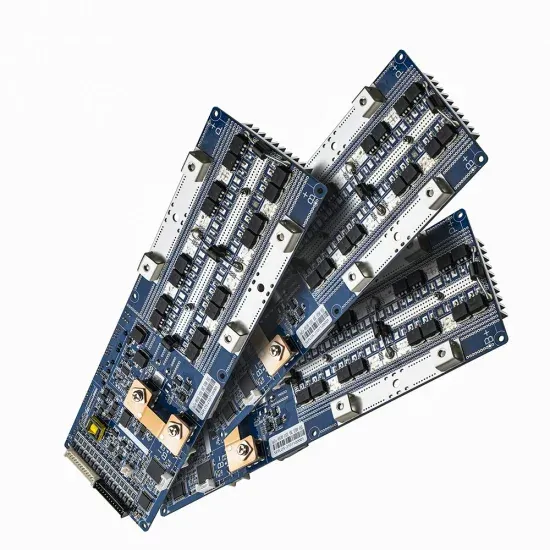

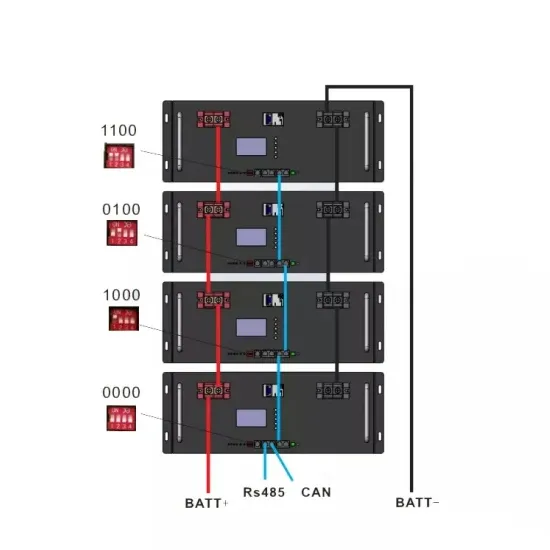

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.