Energy storage and power battery development in Southeast Asia

This article introduces the energy storage and battery development status in Southeast Asia, also why it''s developed and Chinese manufacturers in there.

Get Price

Market attractiveness analysis of battery energy storage systems

The study assesses the Battery Energy Storage Systems (BESS) market in Southeast Asia, highlighting its early stage and lack of policies, proposing a BESS market attractiveness index

Get Price

Energy Storage – ASEAN Energy Database System (AEDS)

The Philippines Department of Energy (DOE) and regulators are considering changing rules governing ownership of grid-connected energy storage systems. The current

Get Price

ASEAN Energy Storage Market Size & Share Analysis

The ASEAN Energy Storage Market is expected to reach USD 3.55 billion in 2025 and grow at a CAGR of 6.78% to reach USD 4.92 billion by 2030. GS Yuasa Corporation,

Get Price

Asia Pacific Energy Storage Systems Market Size, Share

The top 5 players operating in Asia Pacific energy storage systems industry include CATL, BYD, LG Energy Solution, Samsung SDI, and Tesla which collectively hold over 35% of the market

Get Price

Top Energy Storage Companies Leading in Innovation

Explore a list of top 10 energy storage companies and learn why EVB is a leading battery energy storage system manufacturer, renowned for innovative and reliable energy

Get Price

ASEAN Energy Storage Market 6.78 CAGR Growth Outlook 2025

Technologies such as lithium-ion batteries, pumped hydro storage, and advanced thermal systems are becoming essential in the region, as they effectively manage the

Get Price

ABB supplies Southeast Asia''s largest battery energy storage system

With the global energy storage system market expected to reach $17.9 billion by 20271, battery energy storage systems (BESS) are emerging as the strongest solution to increase grid

Get Price

Top 5 Energy Storage Companies in China

Globally, in the field of energy storage, BYD is one of the first heavy players engaged in the energy storage business. In 2008, BYD

Get Price

ABB supplies Southeast Asia''s largest battery energy storage

With the global energy storage system market expected to reach $17.9 billion by 20271, battery energy storage systems (BESS) are emerging as the strongest solution to increase grid

Get Price

ASEAN Energy Storage Market Analysis

The ASEAN region, consisting of ten Southeast Asian countries, has been actively embracing energy storage technologies to address its growing energy demand and to transition towards a

Get Price

Overview: energy storage market in Southeast Asia

Six countries have committed to achieving net zero goals in the future, and renewable energy will accelerate construction. In the meantime, you can learn

Get Price

BESS (Battery Energy Storage System) Company

China''s leading BESS company, dedicated to developing the best battery energy storage system and improve the efficiency of renewable energy storage.

Get Price

ASEAN''s First Energy Storage Manufacturing Hub by SynVista

With the establishment of ASEAN''s first major energy storage manufacturing hub, SynVista Energy is poised to become a transformative force in the region''s clean energy

Get Price

Southeast Asia''s emerging energy storage opportuniti

Wärtsilä has delivered a number of projects in the region, including Singa-pore''s first-ever pilot grid-scale battery energy storage system (BESS) and several large-scale projects in the

Get Price

Energy Storage System

CATL''s energy storage systems provide users with a peak-valley electricity price arbitrage mode and stable power quality management. CATL''s electrochemical energy storage products have

Get Price

ASEAN Energy Storage Market Size & Share Analysis

The ASEAN energy storage market is segmented by type (pumped-hydro storage, battery energy storage systems, and other types), application

Get Price

Energy storage and power battery development in

This article introduces the energy storage and battery development status in Southeast Asia, also why it''s developed and Chinese manufacturers

Get Price

One of Southeast Asia''s largest energy storage systems comes

Sembcorp Industries (Sembcorp) and Singapore''s Energy Market Authority (EMA) have officially opened what is being touted as Southeast Asia''s largest energy storage system.

Get Price

Top 10 Battery Energy Storage System Companies

This product fully covers multi-scenario applications such as power supply side, power grid side, and user side energy storage, and breaks the anxiety of energy storage

Get Price

ASEAN (Bangkok) Energy Storage & Smart Energy Expo 2026

You can reach detailed information about ASEAN (Bangkok) Energy Storage & Smart Energy Expo 2026 and suppliers providing exhibition services on this page.

Get Price

The Top 10 Battery and Storage Companies

Unveiling the Top 10 Largest Solar Farms in the World Where the world''s energy consumption and generation patterns are intermittent, the need

Get Price

Top 10 Energy Storage Companies in Asia

Discover the current state of energy storage companies in Asia, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get Price

Asia Pacific Energy Storage Systems Market Size,

The top 5 players operating in Asia Pacific energy storage systems industry include CATL, BYD, LG Energy Solution, Samsung SDI, and Tesla which

Get Price

ASEAN Energy Storage Market 6.78 CAGR Growth

Technologies such as lithium-ion batteries, pumped hydro storage, and advanced thermal systems are becoming essential in the region, as they

Get Price

White Paper Future of the Grid: Strengthening ASEAN''s Grid

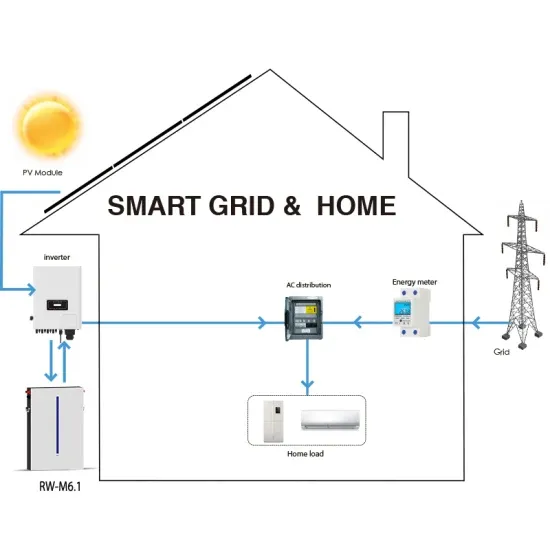

Executive Summary In recent years, the ASEAN''s power grid landscape is evolving. The integration of Distributed Energy Resources (DERs), such as rooftop solar photovoltaics (PV)

Get Price

Energy Storage Solutions & Companies for the Power Industry

Energy storage plays a crucial role in integrating renewable energy sources and enhancing the resilience and emergency response capabilities of power supply systems. By storing the

Get Price

6 FAQs about [ASEAN station-type energy storage system manufacturers]

What is Southeast Asia's largest energy storage system?

Sembcorp Industries (Sembcorp) and Singapore’s Energy Market Authority (EMA) have officially opened what is being touted as Southeast Asia’s largest energy storage system. The Sembcorp energy storage system (ESS) spans two hectares of land in the Banyan and Sakra region on Jurong Island, southwest of the main island of Singapore.

Does ASEAN need energy storage?

The ASEAN energy storage landscape is undergoing a significant transformation driven by the region's ambitious renewable energy goals and growing energy demands. The ASEAN Centre for Energy (ACE) projects the region's total final energy consumption to increase by 146% by 2040, highlighting the urgent need for robust energy storage systems.

Why does Southeast Asia need flexible energy storage solutions?

Southeast Asia's exponential growth in electricity demand, averaging over 6% annually over the past two decades, has created an urgent need for reliable and flexible energy storage solutions. This surge in demand is primarily driven by increasing ownership of household appliances and rising consumption of goods and services across the region.

How is ASEAN transforming its energy landscape?

The ASEAN region is witnessing a significant transformation in its energy landscape, driven by ambitious renewable energy storage targets and the need for grid modernization.

Which countries are adopting battery energy storage systems technology?

Countries like Singapore, the Philippines, and Thailand are leading the adoption of battery energy storage systems technology, with numerous projects under development. The technology's versatility in applications ranging from grid services to behind-the-meter installations for commercial and residential use is driving its adoption.

What is battery energy storage systems (Bess)?

The Battery Energy Storage Systems (BESS) segment is experiencing rapid growth in the ASEAN energy storage market, driven by declining battery costs and increasing renewable energy integration requirements.

More related information

-

Who are the manufacturers of large energy storage cabinets in Yaoundé

Who are the manufacturers of large energy storage cabinets in Yaoundé

-

Kenya distributed energy storage manufacturers

Kenya distributed energy storage manufacturers

-

Ranking of containerized energy storage equipment manufacturers

Ranking of containerized energy storage equipment manufacturers

-

Suriname production of energy storage equipment manufacturers

Suriname production of energy storage equipment manufacturers

-

China s off-grid photovoltaic energy storage manufacturers

China s off-grid photovoltaic energy storage manufacturers

-

What are the types of energy storage system manufacturers

What are the types of energy storage system manufacturers

-

Paraguay supports customized energy storage container manufacturers

Paraguay supports customized energy storage container manufacturers

-

How many energy storage battery manufacturers are there in Greece

How many energy storage battery manufacturers are there in Greece

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.