ASEAN Energy Storage Market Size & Share Analysis

The ASEAN Energy Storage Market is expected to reach USD 3.55 billion in 2025 and grow at a CAGR of 6.78% to reach USD 4.92 billion by 2030. GS Yuasa Corporation,

Get Price

Southeast Asia: Emerging energy storage opportunities

There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high growth in population and energy

Get Price

China Energy Transition Review 2025

For Southeast Asia and other emerging markets, the task ahead is to translate that possibility into tailored strategies. The choices we make today will shape the direction of our economies and

Get Price

Singapore Energy Storage Containers Market Analysis 2026

The Singapore Energy Storage Containers industry boasts a dynamic and well-regulated environment, serving as a strategic hub for regional operations across Southeast Asia.

Get Price

Southeast Asia Automotive Energy Storage System Market

The Southeast Asia Automotive Energy Storage System market continues to demonstrate impressive growth dynamics, with its valuation reaching US$1.23 billion in 2024.

Get Price

Overview: energy storage market in Southeast Asia

Through this article, let''s take a look at the development of the energy storage markets in Southeast Asia.

Get Price

Energy storage systems in Southeast Asia: Four Real-World

Four original case studies of solar power inverter systems with lithium batteries deployed in Southeast Asia—design choices, performance insights, and how storage cuts

Get Price

Southeast Asia''s largest Energy Storage project

Singapore-based energy and urban development company Sembcorp Industries has officially opened the 285-MWh utility-scale energy

Get Price

Southeast Asia''s upstream energy sector: Tackling

Southeast Asia''s upstream energy sector is at a pivotal moment, balancing significant challenges and promising opportunities. On one hand,

Get Price

Southeast Asia: Emerging energy storage opportunities

There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high

Get Price

Southeast Asia''s emerging energy storage opportuniti

"Most people have a feeling that yes, energy storage is going to be part of the solution, but they don''t know exactly what benefit it is going to provide in terms of emission reduction, plus also

Get Price

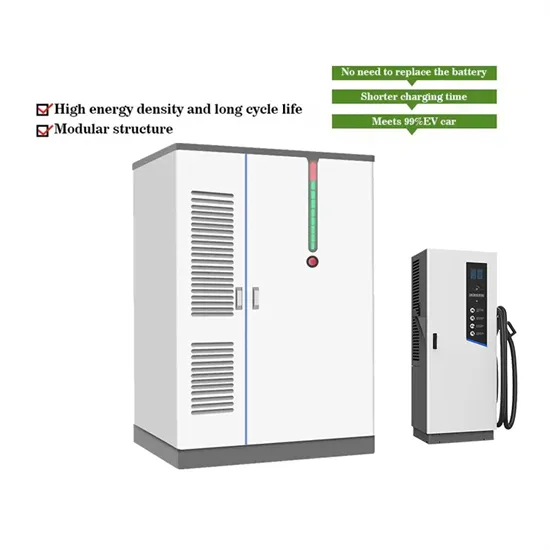

Containerized Battery Energy Storage System

Containerized Battery Energy Storage Systems (BESS) are essentially large batteries housed within storage containers. These systems

Get Price

Unlocking Southeast Asia''s Energy Transition with Storage: Briefing

This briefing "Energy Transition in Southeast Asia: Solving the Storage Problem" by Clifford Chance examines the regulatory frameworks currently in place in Southeast Asia, what

Get Price

Southeast Asia''s Largest Energy Storage System Officially Opens

Sembcorp Industries (Sembcorp) and the Energy Market Authority (EMA) today officially opened the Sembcorp Energy Storage System (ESS). The Sembcorp ESS is

Get Price

Southeast Asia''s Energy Transition is Walking a Tightrope

Southeast Asia''s energy transition faces a delicate balance between phasing out fossil fuels, safeguarding jobs, and adapting to shifting geopolitics. Can ASEAN align vision

Get Price

Southeast Asia''s First Floating and Stacked Energy

Southeast Asia''s first floating and stacked Energy Storage System (ESS) has been deployed at Seatrium Limited''s (Seatrium) Floating Living Lab

Get Price

North asia container energy storage box price

Our energy storage systems are available in various capacities ranging from: 10 ft High Cube Container - up to 680kWh. 20 ft High Cube Container - up to 2MWh. 40 ft High Cube

Get Price

SEA''s largest Energy Storage System opens in

The Sembcorp Energy Storage System (ESS), the largest in Southeast Asia, has officially opened, following its commissioning in

Get Price

Sembcorp Energy Storage System (ESS) | Southeast

The new Sembcorp Energy Storage System (ESS) on Jurong Island, Singapore is Southeast Asia''s largest ESS. ⚡ Commissioned in just six months, the

Get Price

Asia''s Container Shipping Market: Challenges and Opportunities

Southeast Asia, particularly Vietnam and Malaysia, is emerging as a key alternative to China for manufacturing and shipping. Ports like Ho Chi Minh City and Port

Get Price

Energy Transition in Southeast Asia: Solving the storage problem

This briefing examines the regulatory frameworks currently in place in Southeast Asia, what more can be done, and the revenue models necessary to attract private sector

Get Price

Asia Energy Storage Container: Trends, Innovations, and Market

Why Asia''s Energy Storage Container Market Is Booming Like Never Before Ever wondered how a steel box could become the hottest commodity in Asia''s energy sector? Let''s unpack this

Get Price

ASEAN Energy Storage Market 6.78 CAGR Growth Outlook 2025

The size of the ASEAN Energy Storage Market was valued at USD 3.32 Million in 2023 and is projected to reach USD 5.25 Million by 2032, with an expected CAGR of 6.78%

Get Price

ASEAN Energy Storage Market 6.78 CAGR Growth

The size of the ASEAN Energy Storage Market was valued at USD 3.32 Million in 2023 and is projected to reach USD 5.25 Million by 2032, with

Get Price

One of Southeast Asia''s largest energy storage systems comes

Sembcorp Industries (Sembcorp) and Singapore''s Energy Market Authority (EMA) have officially opened what is being touted as Southeast Asia''s largest energy storage system.

Get Price

5 FAQs about [Southeast Asia Container Energy Storage Quotes]

Is Southeast Asia a good place to invest in energy storage?

Image: ACEN. There has been an uptick in energy storage investment in Southeast Asia, a region still largely powered by coal and experiencing high growth in population and energy demand. Andy Colthorpe speaks with companies working to establish a framework of opportunities in the region.

Why does Southeast Asia need flexible energy storage solutions?

Southeast Asia's exponential growth in electricity demand, averaging over 6% annually over the past two decades, has created an urgent need for reliable and flexible energy storage solutions. This surge in demand is primarily driven by increasing ownership of household appliances and rising consumption of goods and services across the region.

Does ASEAN need energy storage?

The ASEAN energy storage landscape is undergoing a significant transformation driven by the region's ambitious renewable energy goals and growing energy demands. The ASEAN Centre for Energy (ACE) projects the region's total final energy consumption to increase by 146% by 2040, highlighting the urgent need for robust energy storage systems.

How is ASEAN transforming its energy landscape?

The ASEAN region is witnessing a significant transformation in its energy landscape, driven by ambitious renewable energy storage targets and the need for grid modernization.

Which countries are adopting battery energy storage systems technology?

Countries like Singapore, the Philippines, and Thailand are leading the adoption of battery energy storage systems technology, with numerous projects under development. The technology's versatility in applications ranging from grid services to behind-the-meter installations for commercial and residential use is driving its adoption.

More related information

-

Southeast Asia Energy Storage Power Market Quotes

Southeast Asia Energy Storage Power Market Quotes

-

Southeast Asia Energy Storage Power Generation

Southeast Asia Energy Storage Power Generation

-

Southeast Asia Telecom Energy Storage Cabinet

Southeast Asia Telecom Energy Storage Cabinet

-

Southeast Asia s user-side energy storage cabinet policies

Southeast Asia s user-side energy storage cabinet policies

-

North Asia s custom-made container energy storage

North Asia s custom-made container energy storage

-

Southeast Asian container battery energy storage system manufacturer

Southeast Asian container battery energy storage system manufacturer

-

West Asia Energy Storage Container House Design

West Asia Energy Storage Container House Design

-

West Asia Container Energy Storage Cabinet

West Asia Container Energy Storage Cabinet

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.