Investment and risk appraisal in energy storage systems: A real

The increasing penetration of variable renewable energy is becoming a key challenge for the management of the electrical grid. Electrical Energy Storage Systems (ESS)

Get Price

Battery Energy Storage System Financial Model

Financial Model providing a dynamic up to 10-year financial forecast for the development of a Green Filed Battery Energy Storage System (BESS) Facility.

Get Price

Minimization of total costs for distribution systems with battery

The considered costs include (1) investment, operation, and maintenance (O&M) costs of WFs, PVFs, and BESS; (2) imported energy cost for loads and power losses from the

Get Price

Frontiers | Environmental Benefit and Investment

Based on the model, simulation results, including the investment value and operation decision of the hydrogen energy storage system with

Get Price

Operating and Investment Models for Energy Storage Systems

As a result, many publications on ESS models with various goals and operating environments are available. This paper aims at presenting the results of these papers in a

Get Price

Business Models and Profitability of Energy Storage

Here we first present a conceptual framework to characterize business models of energy storage and systematically differentiate investment opportunities.

Get Price

Optimization Planning and Cost-Benefit Analysis of Energy Storage

In the context of the electricity market and a low-carbon environment, energy storage not only smooths energy fluctuations but also provides value-added services. This

Get Price

Economic Operation Analysis of Energy Storage System in Smart

Regarding the continuing increase of renewable energy in smart grid, energy storage system (ESS) has play an important role in deal with the fluctuation of new energy, such as PV and

Get Price

Regional Investment and Operations Model Description

Regional Investment and Operations Model Description The Regional Investment and Operations model (RIO) is a highly temporally resolved capacity expansion model that is designed to

Get Price

On the Distributed Energy Storage Investment and Operations

We analyze an energy storage facility location problem and compare the benefits of centralized storage (adjacent to a central energy generation site) versus distributed storage

Get Price

Operating and Investment Models for Energy Storage

As a result, many publications on ESS models with various goals and operating environments are available. This paper aims at presenting the

Get Price

Proforma Financial Model of BESS – Acelerex

Battery Energy Storage Systems (BESS) have become a crucial element in modern energy markets, providing grid stability, renewable energy integration, and cost optimization.

Get Price

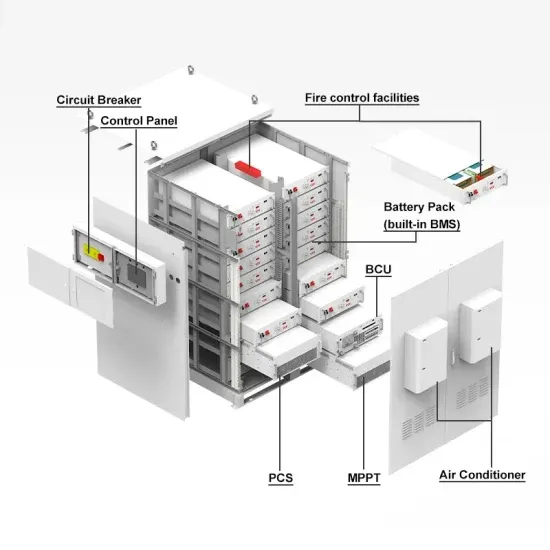

World Bank Document

Alternating current Asian Development Bank Battery energy storage system (see Glossary) Battery management system (see Glossary) Balance of System (see Glossary) British

Get Price

A new investment decision-making model of hydrogen energy storage

Therefore, a component-based technology learning curve model is developed to predict the future costs, furthermore, by integrating real-time operation optimization over the

Get Price

Operating and Investment Models for Stationary Energy

Abstract—Energy storage systems (ESS) have operating char-acteristics that enable them to offer balancing services to the system, perform energy arbitrage in the markets, and help the

Get Price

Battery Energy Storage System (BESS)

Financial Model providing a dynamic up to 10-year financial forecast for the development of a Green Filed Battery Energy Storage System

Get Price

Storage Futures Study: Storage Technology Modeling Input

The SFS is designed to examine the potential impact of energy storage technology advancement on the deployment of utility-scale storage and the adoption of distributed storage, and the

Get Price

Modeling Energy Storage s Role in the Power System of the

What is the least-cost portfolio of long-duration and multi-day energy storage for meeting New York''s clean energy goals and fulfilling its dispatchable emissions-free resource needs?

Get Price

Energy Storage Valuation: A Review of Use Cases and Modeling

Disclaimer This report was prepared as an account of work sponsored by an agency of the United States government. Neither the United States government nor any agency thereof, nor any of

Get Price

photovoltaic–storage system configuration and operation

Furthermore, taking into account the impact of the step–peak–valley tariff on the user''s long-term energy use strategy, a two-layer optimization operation algorithm for the

Get Price

Optimization Planning and Cost-Benefit Analysis of Energy

In the context of the electricity market and a low-carbon environment, energy storage not only smooths energy fluctuations but also provides value-added services. This

Get Price

Analysis of the Shared Operation Model and Economics of

In this paper, a shared energy storage optimization model is established consisting of operators aggregating distributed energy storage and power users leasing shared energy

Get Price

Optimal sizing and siting of energy storage systems based on

The goal for grid-side energy storage investors is to optimize the benefits brought by energy storage deployment, minimizing the construction and operational investment costs

Get Price

Energy Storage Investment and Operation in Eficient Electric

In this essay, we explore what economic theory implies about the general properties of cost-efficient electric power systems in which storage performs energy arbitrage to help

Get Price

On the Distributed Energy Storage Investment and Operations

Our model, although parsimonious, captures the elements that are important for storage investment decisions, including stochastic demand, line losses, storage eTM켼ciency, and con

Get Price

6 FAQs about [Energy Storage System Investment and Operation Model]

What are business models for energy storage?

Business Models for Energy Storage Rows display market roles, columns reflect types of revenue streams, and boxes specify the business model around an application. Each of the three parameters is useful to systematically differentiate investment opportunities for energy storage in terms of applicable business models.

What are the different types of energy storage investment decisions?

There are two basic types of energy storage investment decisions: siting and sizing. Siting refers to the decisions on the optimal ESS placement within a grid, while sizing refers to the decisions on its power and energy ratings.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

What is a business model for storage?

We propose to characterize a “business model” for storage by three parameters: the application of a storage facility, the market role of a potential investor, and the revenue stream obtained from its operation (Massa et al., 2017).

What is the optimal capacity allocation model for photovoltaic and energy storage?

Secondly, to minimize the investment and annual operational and maintenance costs of the photovoltaic–energy storage system, an optimal capacity allocation model for photovoltaic and storage is established, which serves as the foundation for the two-layer operation optimization model.

Can energy storage improve the return on investment?

In literature , an annual total cost minimization model is proposed, which considers the aging costs of PV and energy storage batteries for residential customers. It is concluded that installing the optimal capacity of energy storage can improve the return on investment.

More related information

-

Huawei s energy storage project investment model

Huawei s energy storage project investment model

-

French energy storage investment projects

French energy storage investment projects

-

Investment and Franchise Conditions for Japanese Energy Storage Power Stations

Investment and Franchise Conditions for Japanese Energy Storage Power Stations

-

Energy Storage Cabinet Battery Investment Recommendations

Energy Storage Cabinet Battery Investment Recommendations

-

Latvian distributed energy storage cabinet cooperation model

Latvian distributed energy storage cabinet cooperation model

-

Energy storage photovoltaic power station investment

Energy storage photovoltaic power station investment

-

Icelandic energy storage power station profit model

Icelandic energy storage power station profit model

-

Indonesia energy storage power station operation time

Indonesia energy storage power station operation time

Commercial & Industrial Solar Storage Market Growth

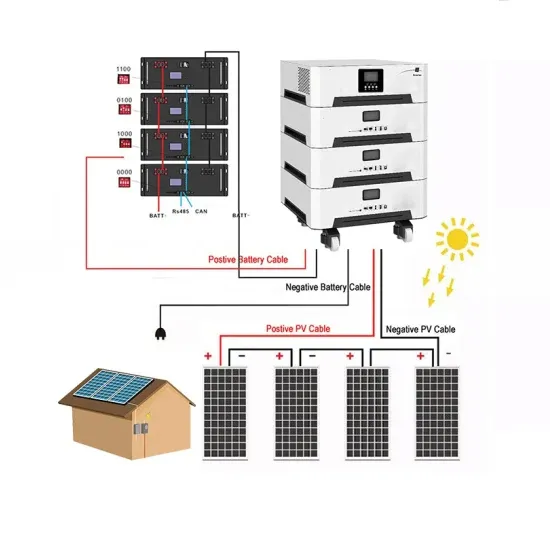

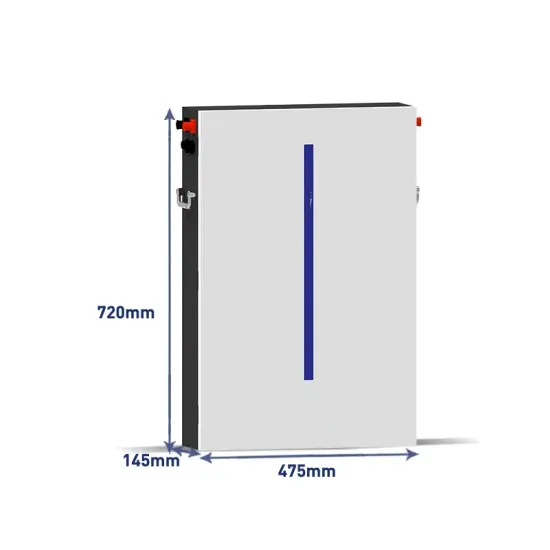

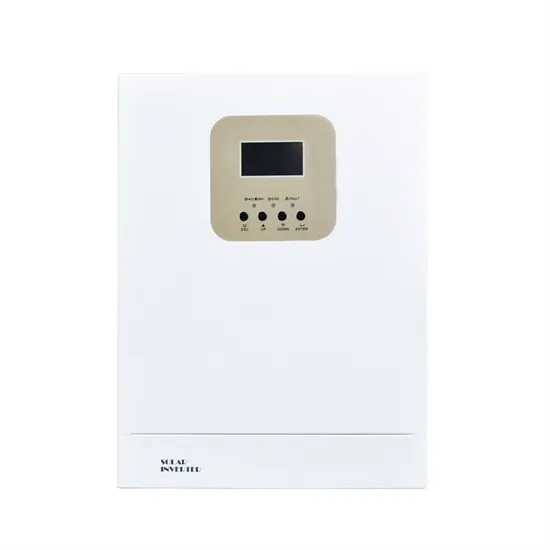

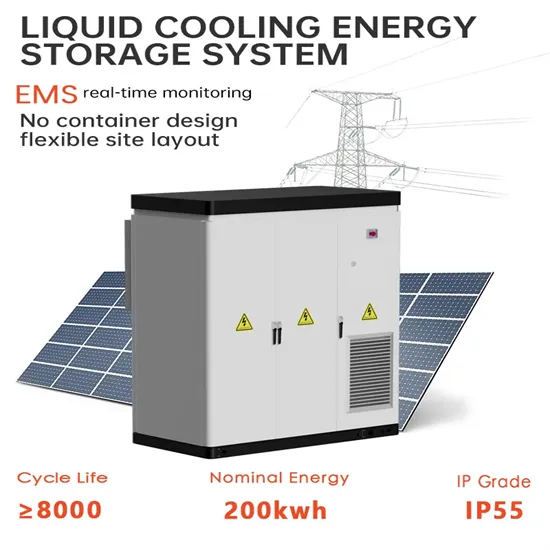

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.