Next step in China''s energy transition: energy storage deployment

China''s industrial and commercial energy storage is poised for robust growth after showing great market potential in 2023, yet critical challenges remain.

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S. News

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays. The landmark tax-and-spending legislation signed into law by President

Get Price

Project Developers Are Bullish On The Thermal Energy Storage

2 days ago· The emergence of thermal energy storage project developers affirms our expectations for growth in the TES industry. The main driver for manufacturers is cost savings.

Get Price

A strong quarter for new investment in renewable energy and storage

Investment in energy storage projects, critical for the growth of generation and grid stability, also continued to power ahead, with eight projects setting a new 12-month quarterly

Get Price

ENERGY STORAGE PROJECTS

Accelerated by DOE initiatives, multiple tax credits under the Bipartisan Infrastructure Law and Inflation Reduction Act, and decarbonization goals across the public and private sectors,

Get Price

Energy Storage Program

Integrating storage in the electric grid, especially in areas with high energy demand, will allow clean energy to be available when and where it is most

Get Price

U.S. Energy Storage Industry to Invest $100 Billion in

Today''s investment commitment aims to advance a manufacturing expansion in the United States that could enable American-made batteries to satisfy 100% of domestic energy storage project

Get Price

Energy Storage Investments – Publications

Estimates indicate that global energy storage installations rose over 75% (measured by MWhs) year over year in 2024 and are expected to go beyond the terawatt-hour

Get Price

The 360 Gigawatts Reason to Boost Finance for Energy Storage

And that initial support package has spurred an ambitious follow-on initiative expected to mobilize an incredible $152.4 million in new investment, install 90 MWh of battery

Get Price

ENERGY STORAGE PROJECTS

ENERGY STORAGE PROJECTS Reaching Full Potential: LPO investments across energy storage technologies help ensure clean power is there when it''s

Get Price

The 10 most attractive energy storage investment markets

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is complex, so which markets offer the

Get Price

ENERGY STORAGE PROJECTS

Accelerated by DOE initiatives, multiple tax credits under the Bipartisan Infrastructure Law and Inflation Reduction Act, and decarbonization goals

Get Price

Eolian claims first use of new energy storage ITC for Texas BESS

Eolian is a specialist energy storage investor and developer owned by Global Infrastructure Partners. Image: Eolian. Energy storage developer Eolian has completed an

Get Price

Governor Hochul Announces First Bulk Energy

Governor Hochul announced the launch of New York''s first Bulk Energy Storage Request for Proposals (RFP), intended to procure one

Get Price

New Funding Scheme Unveiled to Attract Investment

The UK is moving closer to achieving energy independence as the government introduces a new initiative aimed at developing energy storage infrastructure.

Get Price

Energy Department Pioneers New Energy Storage

The Department of Energy''s (DOE) Office of Electricity (OE) is pioneering innovations to advance a 21st century electric grid. A key

Get Price

Renewable Energy Systems and Infrastructure | Investment

Footnotes i These data include stationary storage projects (large- and small-scale) but do not include pumped hydropower, compressed air or hydrogen. The majority are battery projects.

Get Price

7 Energy Storage Stocks to Invest In | Investing | U.S.

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays. The landmark tax-and-spending

Get Price

Top 10 New Energy Storage Investments Shaping 2025 (and

As we ride this storage tsunami into 2026, remember: the energy transition isn''t just about saving the planet – it''s about making your portfolio bulletproof. The question is:

Get Price

What are the energy storage investment projects? | NenPower

The future of energy storage investment projects may involve increased interconnection and collaboration among diverse stakeholders. Examples include utilities

Get Price

Top 10 Energy Storage Investors in North America | PF Nexus

Discover the current state of energy storage investors in North America, learn about buying and selling energy storage projects, and find financing options on PF Nexus.

Get Price

New energy storage investment projects

Will battery energy storage investment hit a record high in 2023? After solid growth in 2022,battery energy storage investment is expected to hit another record high and exceed

Get Price

Arevon Surpasses $10 Billion in Operating Assets, Expanding Its

3 days ago· The company owns and operates more than 5.3 gigawatts (GW) of solar, energy storage, and solar-plus-storage projects across 17 U.S. states, representing more than $10

Get Price

Massachusetts, New England States Selected to

States selected to receive highly competitive funds from the U.S. Department of Energy''s Grid Innovation Program for transmission upgrades in

Get Price

Major Projects Office of Canada: Initial Projects under Consideration

16 hours ago· These projects will create the infrastructure to diversify our trading relationships, unlock new markets, and position Canada as both a cle an-ene rgy and conventio nal-e nergy

Get Price

GSP, partner cash in on 1.25-GW battery project portfolio in US

Granite Source Power LLC (GSP), along with its partner New Energy Capital (NEC), has sold a portfolio of nearly 1,250 MW of standalone battery energy storage system

Get Price

The 10 most attractive energy storage investment

Reliable electricity grids backed up by battery energy storage systems (BESS) are vital for the energy transition – but investing in BESS is

Get Price

What are the energy storage investment projects?

The future of energy storage investment projects may involve increased interconnection and collaboration among diverse stakeholders.

Get Price

6 FAQs about [New energy storage project investment]

How will energy storage help a net-zero economy by 2050?

Accelerated by DOE initiatives, multiple tax credits under the Bipartisan Infrastructure Law and Inflation Reduction Act, and decarbonization goals across the public and private sectors, energy storage will play a key role in the shift to a net-zero economy by 2050.

Are energy storage technologies the key to reducing energy costs?

Energy storage technologies are also the key to lowering energy costs and integrating more renewable power into our grids, fast. If we can get this right, we can hold on to ever-rising quantities of renewable energy we are already harnessing – from our skies, our seas, and the earth itself. The gap to fill is very wide indeed.

What is energy storage?

Energy storage encompasses an array of technologies that enable energy produced at one time, such as during daylight or windy hours, to be stored for later use. LPO can finance commercially ready projects across storage technologies, including flywheels, mechanical technologies, electrochemical technologies, thermal storage, and chemical storage.

Should storage projects be funded?

One large missing piece has been funding. Storage projects are risky investments: high costs, uncertain returns, and a limited track record. Only smart, large-scale, low-cost financing can lower those risks and clear the way for a clean future.

Are energy storage systems in demand?

Energy storage systems are increasingly in demand to increase the effectiveness of solar power arrays, with the Energy Information Administration estimating in February that new utility-scale electric-generating capacity on the U.S. power grid will hit a record in 2025 after a 30% increase over the prior year.

How many new storage projects have been approved in the developing world?

Twelve new projects across the developing world have already been approved, including in Bangladesh, Brazil, Colombia, Haiti, Honduras, India, Indonesia, the Maldives, and Ukraine. In the next three years, CIF plans to create 1.8 GW of new storage capacity and integrate an additional 16 GW.

More related information

-

New energy solar energy storage project investment

New energy solar energy storage project investment

-

Personal energy storage project investment

Personal energy storage project investment

-

New Zealand Energy Storage Project Climbing Frame

New Zealand Energy Storage Project Climbing Frame

-

The world s largest energy storage investment project

The world s largest energy storage investment project

-

New energy storage project in Afghanistan

New energy storage project in Afghanistan

-

Vatican Industrial and Commercial Energy Storage Investment Project

Vatican Industrial and Commercial Energy Storage Investment Project

-

How much investment is needed for Kuwait s energy storage project

How much investment is needed for Kuwait s energy storage project

-

Energy Storage Project New Energy

Energy Storage Project New Energy

Commercial & Industrial Solar Storage Market Growth

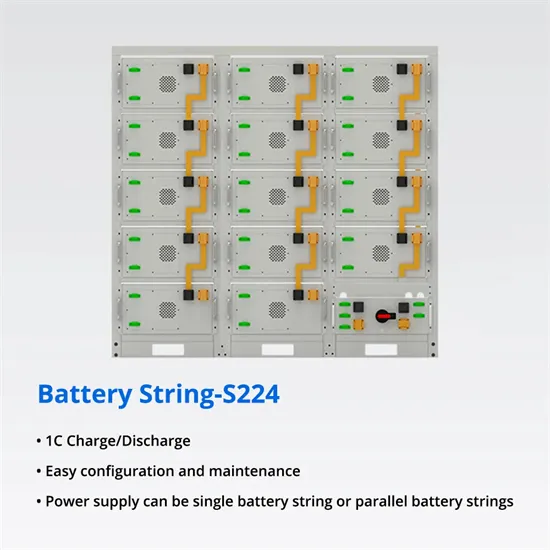

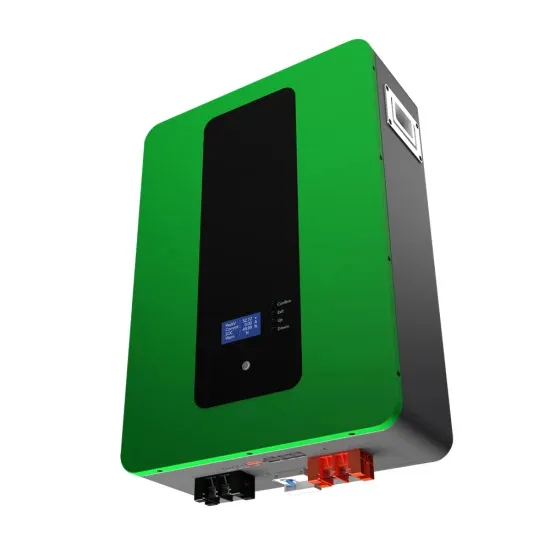

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.