Base Station Market Forecasts Robust Growth Driven by Telecom...

The global Base Station Market is witnessing remarkable expansion, fueled by rapid advancements in telecommunications infrastructure and widespread deployment of 5G

Get Price

Somalia to get 100% 4G Coverage by 2023

However despite the anarchy which continues to disrupt the country, the telecoms market, dominated by the competitive mobile sector

Get Price

Infrastructure agreement provides communication services to Somaliland

A new agreement will bring voice, Internet, TV and video communication services to customers in Somaliland, a self-declared sovereign state that is internationally recognised

Get Price

5G Base Station Construction Market in Thailand

The global 5G base station construction market is expected to grow with a CAGR of 25.7% from 2025 to 2031. The 5G base station construction market in Thailand is also forecasted to

Get Price

List of Mobile Operators in Somalia

The competitive landscape among these operators has driven innovation, leading to improved services and competitive pricing. Additionally, the presence of MVNOs and a variety

Get Price

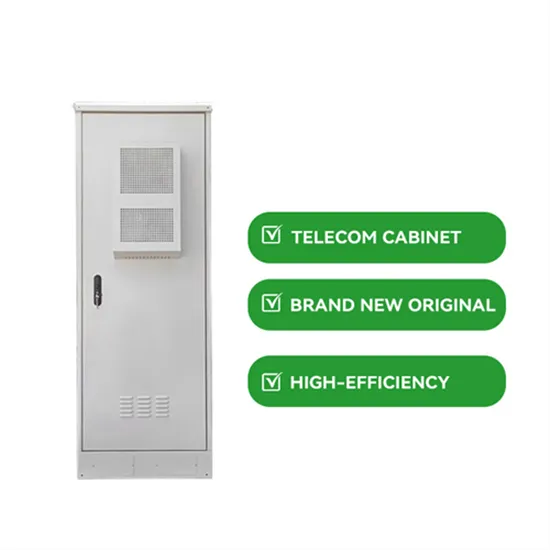

Telecoms Sector Guide | SomalilandBiz

Somaliland''s telecoms sector has been funded by entrepreneurs and backed by expertise from China, Korea and Europe, these nascent telecommunications firms offer affordable mobile

Get Price

Resource management in cellular base stations powered by

This paper aims to consolidate the work carried out in making base station (BS) green and energy efficient by integrating renewable energy sources (RES). Clean and green

Get Price

New interconnection deal for Somaliland operators

Two of Somaliland''s operators, Somtel and Telesom, have agreed to enable interconnecting calls between their networks. The Somaliland Chronicle reported that the deal

Get Price

4G Base Station Market | Size, share, status 2025 forecast to 2032

Global 4G Base Station market size was valued at USD 5,321 million in 2024. The market is projected to decline to USD 866 million by 2032, exhibiting a negative CAGR of 23.4% during

Get Price

Somalia

Many of the main telecommunications companies operate across the Somali region, albeit under different names. The telecoms operators are closely intertwined with mobile money,

Get Price

Somalia Communications 2024, CIA World Factbook

NOTE: The information regarding Somalia on this page is re-published from the 2024 World Fact Book of the United States Central Intelligence Agency and other sources. No claims are made

Get Price

New interconnection deal for Somaliland operators

The Somaliland Chronicle reported that the deal was signed on 19 th February following a series of meetings held at the Ministry of Information and Communication

Get Price

Portable Communication Base Station Market Report: Trends,

Portable Communication Base Station Market Trends and Forecast The future of the global portable communication base station market looks promising with opportunities in the military,

Get Price

4G 5G Base Station Market Report | Global Forecast From 2025

The global 4G and 5G base station market size is projected to grow significantly, from an estimated USD 45.6 billion in 2023 to USD 112.9 billion by 2032, reflecting a CAGR of 10.5%.

Get Price

Wireless Communication Base Station Market Size, Share,

Delve into detailed insights on the Wireless Communication Base Station Market, forecasted to expand from USD 45.6 billion in 2024 to USD 80.1 billion by 2033 at a CAGR of 6.7%. The

Get Price

A new dawn for Somaliland Telecom sector? Or is it?

The ensuing benefits are huge as Somaliland will be seizing the opportunity to establishing itself as the source of the submarine cables, not just for its home market but for

Get Price

Telecommunications in Somaliland

Telecommunications in Somaliland, an internationally unrecognised republic claimed by Somalia, are mainly concentrated in the private sector. A number of local telecommunications firms

Get Price

Communications in Somaliland

There is no telecommunication regulatory institution in Somaliland. There is consensus amongactors that it would be desirable, but Somaliland is at the beginning of the institutional

Get Price

Somalia Telecoms Market report, Statistics and Forecast 2020

More recently, three types of licenses have been issued to operators, providing clarity and bringing the market closer into line with international standards. The regulator has also made

Get Price

Somalia Telecoms Market report, Statistics and Forecast 2020

Government sets up a National Emergency Telecom Plan establishing a unified communications framework for its disaster response efforts. Report includes updated Telecom Maturity Index

Get Price

GSMA and International Finance Corpor...

The GSMA, the body that represents the worldwide mobile communications industry, today announced that its Green Power for Mobile (GPM) programme is working with

Get Price

Wireless Communication Base Station Market Size, Key

Wireless Communication Base Station Market size was valued at USD 45.6 Billion in 2024 and is forecasted to grow at a CAGR of 6.

Get Price

FINAL_ICT_SUSIP Investment Promotion Interventions

Although some operators have built their own microwave and fiber backbone links in some areas, Somalia is currently seeking investments for an open competitive market in national and

Get Price

6 FAQs about [Somaliland Operator Communications Green Base Station Market]

What telecommunications companies are in Somaliland?

Blank Somaliland Map. Telecommunications in Somaliland, an internationally unrecognised republic claimed by Somalia, are mainly concentrated in the private sector. A number of local telecommunications firms operate in the region, including Golis Telecom Somalia, SomCable, Somtel and Telesom.

Who are the major mobile operators in Somalia?

Here is a detailed overview of the major mobile operators in Somalia: Ownership: Somtel, or Somali Telecom, is a telecommunications company headquartered in Hargeisa, Somaliland, an autonomous region in Somalia. It is one of the oldest and largest telecommunications providers in Somaliland.

How is telecommunications regulated in Somaliland?

Somaliland’s Telecommunications Sector is regulated by the Ministry of Posts & Telecommunications based in the national capital, Hargeisa. On 13th June 2011, the House of Elders passed the law, without any amendments, on an overwhelming majority of 75 for, 1 against and none abstaining.

Could a lack of standardization affect Somaliland's telecoms sector?

This lack of standardization in Somaliland’s telecoms sector could potentially have serious repercussions for the sector and limit the ability of the state to broaden their tax revenues among Somaliland’s leading operators.

How does Somaliland's telecoms work?

Somaliland’s telecoms consumers are able to make the cheapest local and international calling rates in the world. Customers can conduct money transfers and other banking activities via mobile phones, as well as easily gain wireless access.

Is Somaliland a telecommunications country?

Prior to Somaliland’s re-independence in 1991, the telecoms sector was heavily monopolized by the central government led by the corrupt regime of Siad Barre. Since the overthrow of his regime, Somaliland has developed a modern and telecommunications industry with widespread mobile usage among the populace.

More related information

-

Micronesia Communications Green Base Station Photovoltaic Power Generation Parameters

Micronesia Communications Green Base Station Photovoltaic Power Generation Parameters

-

Equatorial Guinea Communications Green Base Station Lightning Protection

Equatorial Guinea Communications Green Base Station Lightning Protection

-

Norway Communications Green Base Station Tower

Norway Communications Green Base Station Tower

-

Sierra Leone Tower Communications green base station

Sierra Leone Tower Communications green base station

-

Madagascar Communications Green Base Station Development

Madagascar Communications Green Base Station Development

-

China Communications Green Base Station Photovoltaic Power Generation Supply

China Communications Green Base Station Photovoltaic Power Generation Supply

-

Cape Verde Communications Green Base Station Contracting

Cape Verde Communications Green Base Station Contracting

-

Korea Communications Green Base Station Cost Price

Korea Communications Green Base Station Cost Price

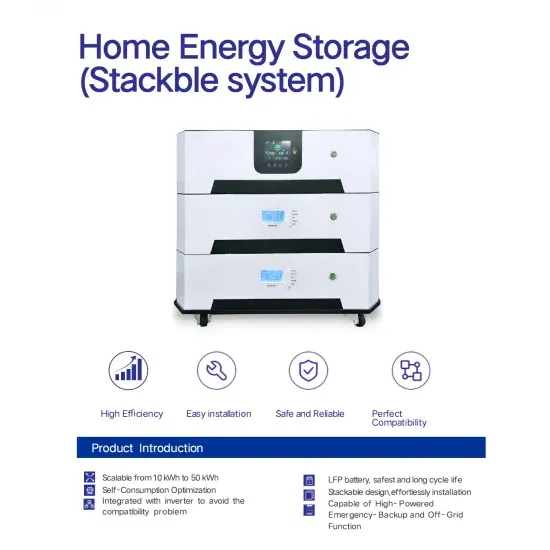

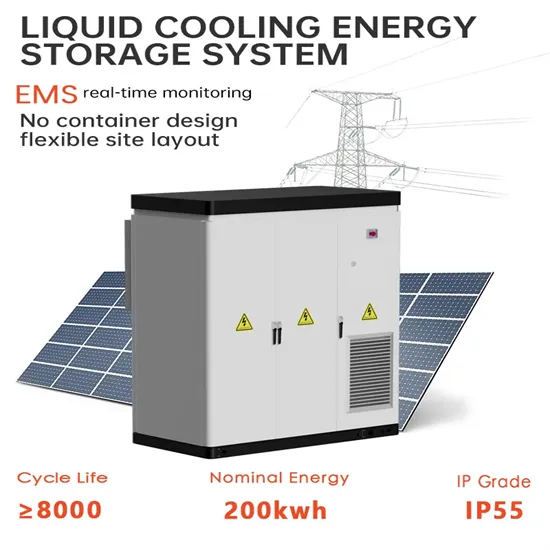

Commercial & Industrial Solar Storage Market Growth

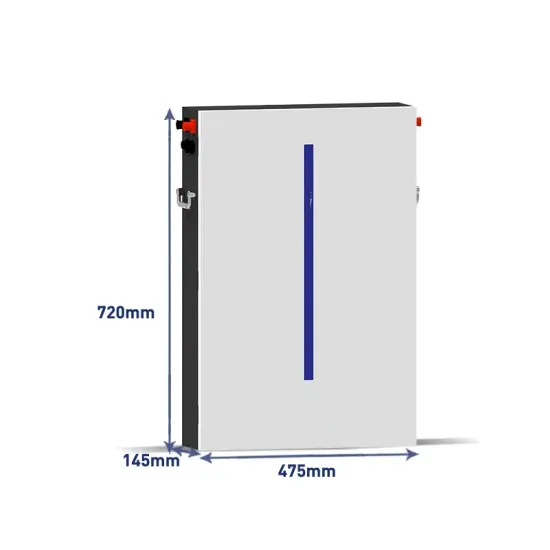

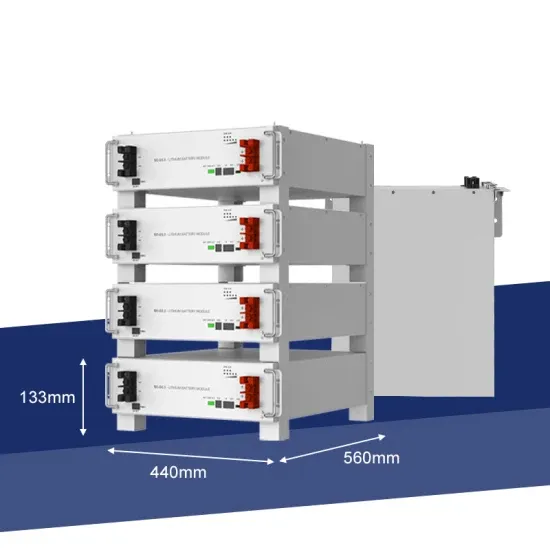

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.