Business models for distributed energy resources: A review and

This paper presents a novel, empirical analysis of the most common business models for the deployment of demand response and energy management systems, electricity

Get Price

4 major business models of energy storage

At present, the financial leasing business model is the most common business model for energy storage, and it is also the business operation model with the widest

Get Price

A novel business model and charging and discharging pricing

A pricing optimization model for charging and discharging centralized energy storage is constructed within this new business model, employing the NSGA-II genetic

Get Price

Publications | Distributed Generation Market Demand Model | NREL

Publications These publications—including technical reports, journal articles, conference papers, and posters—either focus on or were heavily informed by the Distributed

Get Price

Distributed Energy Storage: The Future''s Leading Edge

By creating innovative business models, the distributed energy storage industry not only enhances its economic viability but also contributes

Get Price

Shared Energy Storage Business and Profit Models: A Review

As a new paradigm of energy storage industry under the sharing economy, shared energy storage (SES) can effectively improve the comprehensive regulation ability and safety

Get Price

Business models for distributed energy resources: A review

Distributed energy resources (DERs) Solar Photovoltaics Demand response Energy storage Business model ontology Energy services energy resources. We classify the revenue streams,

Get Price

Distributed energy storage business models

At present, the business model of financial leasing is the most common business model for energy storage, and it is also the business operation model with the

Get Price

Research on Application Value and Business Model of Distributed

Research on Application Value and Business Model of Distributed Photovoltaic and Energy Storage Published in: 2024 IEEE 8th Conference on Energy Internet and Energy System

Get Price

Business Models to Accelerate the Utilization of Distributed

Renewable energy mandates such as renewable portfolio standards (RPS), clean peak standards, energy storage targets, and other distributed renewable resources-related policies

Get Price

Distributed Solar and Storage Adoption Modeling

These scenarios are modeled in the ReEDS model. Distributed Storage Adoption Scenarios (Technical Report): A report on the various future distributed storage capacity

Get Price

5 Business Models of Distributed Energy Storage

Energy storage project developers lease energy storage systems to users to reduce peak electricity bills and demand electricity bills and provide backup power. The lease

Get Price

Con Edison Proposes New Energy Storage Business

Consolidated Edison wants to test out a new energy storage business model in a project planned with microgrid developer GI Energy at

Get Price

Business models for distributed energy resources

This paper presents a novel, empirical analysis of the most common business models for the deployment of distributed energy resources. Specifically, this

Get Price

Distributed energy storage business models

At present, the business model of financial leasing is the most common business model for energy storage, and it is also the business operation model with the widest range of applications for

Get Price

Analysis of Distributed Energy Storage Business

1. Analysis of the Business Value of Distributed Energy Storage Distributed energy storage has attracted considerable attention in recent years

Get Price

Business Model Selection for Community Energy

This paper explores business models for community energy storage (CES) and examines their potential and feasibility at the local level. By

Get Price

Distributed Energy Resource Management Systems

Distributed Energy Resource Management Systems NREL is leading research efforts on distributed energy resource management systems

Get Price

Energy Storage Valuation: A Review of Use Cases and Modeling

Disclaimer This report was prepared as an account of work sponsored by an agency of the United States government. Neither the United States government nor any agency thereof, nor any of

Get Price

5 Business Models of Distributed Energy Storage

Energy storage should address the needs of players in the system, which may vary per time unit and per step in the value chain. Storage might be needed only for a few sec-onds, or to bridge

Get Price

4 major business models of energy storage

At present, the financial leasing business model is the most common business model for energy storage, and it is also the business

Get Price

Business models for distributed energy storage

The question of how to fully develop the value of distiributed energy storage is one that requires further research and exploration from all countries. At present, a variety of innovative business

Get Price

Energy storage business model analysis

At present, the financial leasing business model is the most common business model for energy storage, and it is also the business operation model with the

Get Price

Business models in energy storage

Energy storage should address the needs of players in the system, which may vary per time unit and per step in the value chain. Storage might be needed only for a few sec-onds, or to bridge

Get Price

Business Models for Distributed Energy Resources

es in each distributed energy resource category. Within each archetype, concrete examples of individual business models are presented, along with notable e. ceptions or extensions of

Get Price

Energy storage business model analysis

At present, the financial leasing business model is the most common business model for energy storage, and it is also the business operation model with the widest application range of

Get Price

Distributed generation

Centralized (left) vs distributed generation (right) Distributed generation, also distributed energy, on-site generation (OSG), [1] or district/decentralized

Get Price

Solar-Plus-Storage Analysis | Solar Market Research & Analysis

Solar-Plus-Storage Analysis For solar-plus-storage—the pairing of solar photovoltaic (PV) and energy storage technologies—NREL researchers study and quantify the unique

Get Price

6 FAQs about [Business model of distributed energy storage]

What are the most common business models for distributed energy resources?

This paper presents a novel, empirical analysis of the most common business models for distributed energy resources. Specifically, it focuses on demand response and energy management systems, electricity and thermal storage, and solar PV business models.

What is the best investment model for distributed energy storage?

"Leasing on behalf of sales" is currently the most widely used investment operation model in the field of distributed energy storage. Stem of the United States, GreenCharge Networks, Entega of Germany, etc. use this model to provide users with energy storage services. 2. Shared revenue model for saving electricity bills

What is distributed energy storage system?

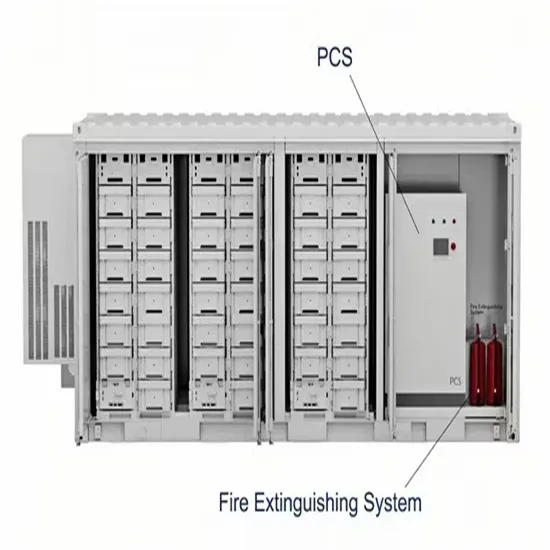

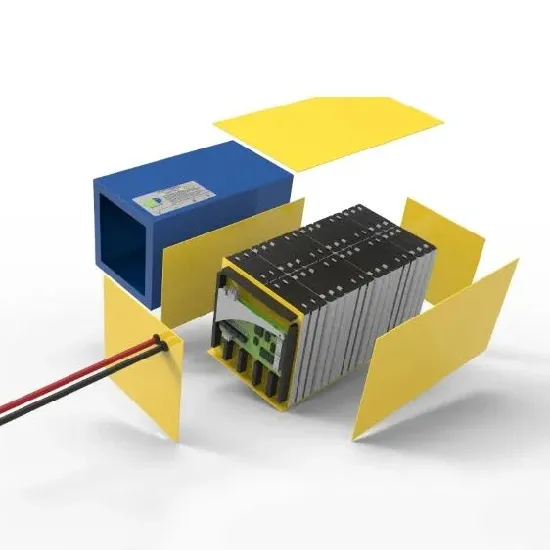

The application of the distributed energy storage (DES) system consists of energy storage systems distributed in the power distribution system and close to the end consumers.

What are the components of 144 distributed energy business models?

In this paper, we have identified the key value capture and creation components of 144 distributed energy business models that are associated with three DER technology categories: demand response and energy management systems, electrical and thermal storage, and solar PV.

Are energy storage business models fully developed?

E Though the business models are not yet fully developed, the cases indicate some initial trends for energy storage technology. Energy storage is becoming an independent asset class in the energy system; it is neither part of transmission and distribution, nor generation. We see four key lessons emerging from the cases.

What are the business models for large energy storage systems?

The business models for large energy storage systems like PHS and CAES are changing. Their role is tradition-ally to support the energy system, where large amounts of baseload capacity cannot deliver enough flexibility to respond to changes in demand during the day.

More related information

-

Huawei s Industrial Energy Storage Business Model

Huawei s Industrial Energy Storage Business Model

-

Business model of industrial and commercial energy storage power station

Business model of industrial and commercial energy storage power station

-

Latvian distributed energy storage cabinet cooperation model

Latvian distributed energy storage cabinet cooperation model

-

Distributed Energy Storage Business

Distributed Energy Storage Business

-

Qatar distributed energy storage cabinet costs

Qatar distributed energy storage cabinet costs

-

Barbados Distributed Energy Storage Project

Barbados Distributed Energy Storage Project

-

Distributed energy storage cabinet ems

Distributed energy storage cabinet ems

-

Cuba distributed energy storage cabinet customization

Cuba distributed energy storage cabinet customization

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.