Top 10 Best Inverter manufactures In China (Update

Explore the top 10 Inverter Manufactures In China for 2024, leading in solar innovation, quality, and efficiency. Find the best partner for

Get Price

How to power Indonesia''s solar PV growth opportunities

Renewable energy is becoming a critical component of the energy landscape in Southeast Asia. Driven by sustainability goals and the urgent

Get Price

Southeast Asia''s green energy transition: 28% PV demand

As the global energy transition accelerates, Southeast Asia has become a key market for renewable energy development. According to InfoLink''s latest data, PV demand in

Get Price

GoodWe inverters are now available from Krannich Solar in Southeast Asia

GoodWe offers a wide range of single and three-phase PV inverters ranging from 0.7 kW to 250 kW which are used worldwide in residential and commercial rooftops and energy storage

Get Price

Top 10 Best Inverter Manufacturers In Asia

In this article, you will find information about the Top 10 Best Inverter Manufacturers in Asia and some others related information.

Get Price

SMA Solar Southeast Asia

SMA South East Asia provides a comprehensive downloads section on their website, offering a wide range of resources for solar professionals and system

Get Price

Inverter & Photovoltaics Solutions | SMA South East Asia

Discover the global specialist for inverters, photovoltaic & solar technology from the private solar system to the megawatt PV power plant.

Get Price

What does it mean to have up to 3,521% US tariffs on

The US Department of Commerce published its final anti-dumping and countervailing duty tariff rates against solar PV (crystalline photovoltaic)

Get Price

2024 Top 20 Global Photovoltaic Inverter Brands

PVTIME – Renewable energy capacity additions reached a significant milestone in 2023, with an increase of almost 50% to nearly

Get Price

Growatt provides inverters for the largest shopping mall in Southeast Asia

Chinese PV inverter provider Growatt recently finished its installation on the rooftop of SM City Bacoor in the Philippines, the largest shopping mall in Southeast Asia. The project

Get Price

GoodWe inverters are now available from Krannich Solar in

GoodWe offers a wide range of single and three-phase PV inverters ranging from 0.7 kW to 250 kW which are used worldwide in residential and commercial rooftops and energy storage

Get Price

News

Manila, Philippines, 4 September, 2025 – Sungrow, the global leading PV inverter and energy storage system provider, successfully hosted its Southeast Asia new product

Get Price

Suitable Solar Inverters for Southeast Asia

Anern''s solar inverters are renowned for their high efficiency, stability, and intelligent management, providing reliable support for solar power generation

Get Price

Top 10 Best Inverter Manufacturers In Asia

In this article, you will find information about the Top 10 Best Inverter Manufacturers in Asia and some others related information.

Get Price

Solar Inverters in Southeast Asia: Market Overview

Growing Demand Southeast Asia''s solar inverter market is expanding rapidly due to rising energy needs, government support for renewables, and decreasing solar costs.

Get Price

Asia Pacific Solar PV Inverters Companies

This report lists the top Asia Pacific Solar PV Inverters companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors

Get Price

Solar powerhouse: China holds the key to Asia''s

"Basically, Southeast Asia is not the only market that will rely heavily on China''s photovoltaic equipment if they want to boost its solar

Get Price

Suitable Solar Inverters for Southeast Asia

Anern''s solar inverters are renowned for their high efficiency, stability, and intelligent management, providing reliable support for solar power generation systems in the Southeast

Get Price

Southeast Asia''s PV market to drive global energy transition

PV has become a key driver for Southeast Asia''s renewable energy development amid global net-zero emissions trend, due to the region''s abundant sunlight, rapid economic

Get Price

Solar Inverter Brands Powering Southeast Asia''s Industry | Mingch

Southeast Asia offers a promising landscape for industries in search of the best solar inverter brands. With the consistent interest of its people in electrical equipment

Get Price

ASEAN Solar PV and Energy Storage Expo 2025: IMPACT Bangkok

The ASEAN Solar PV and Energy Storage Expo 2025 is not just an exhibition; it is a pivotal gathering that seeks to accelerate the transition towards a more sustainable and

Get Price

Solar in Southeast Asia: what''s happening in the

The Philippines aims to have 27GW installed solar capacity by 2040. Credit: ACEN Southeast Asian countries have been ramping up their

Get Price

Southeast Asia Solar Inverter Market: Current Situation And

Vietnam and Thailand will continue to be the largest solar inverter markets in Southeast Asia. The Malaysian and Philippine markets will also maintain steady growth.

Get Price

Asia Pacific Solar PV Inverters Companies

This report lists the top Asia Pacific Solar PV Inverters companies based on the 2023 & 2024 market share reports. Mordor Intelligence expert advisors conducted extensive research and

Get Price

Solar Inverter Brands Powering Southeast Asia''s

Southeast Asia offers a promising landscape for industries in search of the best solar inverter brands. With the consistent interest of its

Get Price

Sungrow Unveils 1+X 2.0 and PowerTitan 3.0 in Manila,

Manila, Philippines, 4 September, 2025 – Sungrow, the global leading PV inverter and energy storage system provider, successfully hosted its Southeast Asia new product launch in Manila,

Get Price

Off Grid Solar Inverter Manufacturers in China

Looking for reliable off grid solar inverter manufacturer? Our China-based solar power inverter factory offers top-quality OEM inverters. Partner with us for

Get Price

5 FAQs about [Southeast Asia Photovoltaic Inverter]

Will PV demand grow in Southeast Asia in 2024?

InfoLink projects that PV demand in Southeast Asia will reach 4.5-7.4 GW in 2024, with long-term demand likely growing to 9.7-12.9 GW, suggesting that the Southeast Asian PV market will maintain steady growth in the coming years, becoming a key player in the global energy transition.

Why is Asia a great place to buy an inverter?

Asia is home to some of the most advanced and innovative inverter manufacturers in the world, catering to a wide range of industries including renewable energy, industrial automation, and transportation. These manufacturers are known for their cutting-edge technologies, reliability, and commitment to energy efficiency.

Which country has the most PV policies in Southeast Asia?

Singapore is considered the most mature country regarding PV policies in Southeast Asia. However, due to geographical limitations, PV projects can hardly be widely established within the country.

What are the challenges facing the Southeast Asian PV market?

Despite the promising outlook, the Southeast Asian PV market faces several challenges. The first major obstacle is the insufficient grid capacity to integrate more solar power. Many countries are working to improve their infrastructure to support the increased feed-in of solar-generated electricity.

Why is Southeast Asia a good place to invest in energy?

Southeast Asia benefits from economic growth, policy support, and international funding but also faces grid integration challenges and competitive pressure from other energy sources.

More related information

-

Asia Photovoltaic Inverter

Asia Photovoltaic Inverter

-

Southeast Asia Photovoltaic Module Project

Southeast Asia Photovoltaic Module Project

-

East Asia Photovoltaic Power Generation Equipment Inverter

East Asia Photovoltaic Power Generation Equipment Inverter

-

Southeast Asia energy storage lithium battery distributor

Southeast Asia energy storage lithium battery distributor

-

Extremely small photovoltaic inverter

Extremely small photovoltaic inverter

-

Photovoltaic low voltage to medium voltage inverter

Photovoltaic low voltage to medium voltage inverter

-

Solar Photovoltaic Sine Wave Inverter

Solar Photovoltaic Sine Wave Inverter

-

Huijue Energy Storage Photovoltaic Inverter

Huijue Energy Storage Photovoltaic Inverter

Commercial & Industrial Solar Storage Market Growth

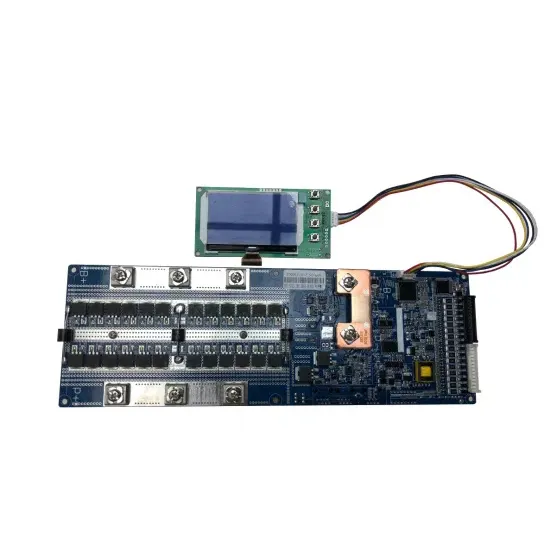

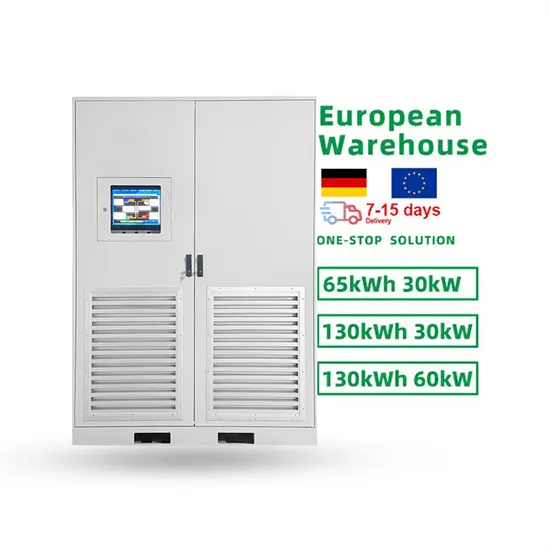

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.