pmwj94 Jun2020 Abdihali Fashina Fankunle Scope Management in Somaliland

Finally, it states that the paper aims to explore the approaches, impacts, constraints and practices of using project scope management for telecommunication projects in Somaliland.

Get Price

Ministry of Post & Telecom inaugurates communication rooms project

Financed by the World Bank through the ICT Support Project, 37 communication rooms were installed at key five institutions for each of Somaliland, Puntland, GalMudug,

Get Price

skouby_tadayoni.doc

Based on cost figures and experiences from the case project described in Box 1 this chapter outlines some realistic scenarios for establishment of ICT connectivity in Somaliland.

Get Price

What is 5G base station architecture?

What are your power requirements? 5G base stations typically need more than twice the amount of power of a 4G base station. In 5G network planning, cellular operators

Get Price

An overview of the applications of project scope

Consequently, this paper attempts to review the overall picture of the applications of project scope management in the telecommunication

Get Price

Telecom Tower Builds, Planning, Managing, and

Telecom Towers Builds: find out all about the efficient planning and management using Allex | We provide in-depth content on successful project management,

Get Price

Optimal configuration of 5G base station energy storage

The high-energy consumption and high construction density of 5G base stations have greatly increased the demand for backup energy storage batteries. To maximize overall

Get Price

The Role of Telecommunications in State-building: The Case of Somaliland

Fortunately, Somaliland is among the countries that have been attending and benefiting from the advancement in the telecommunications sector. This research explores the role of

Get Price

Telecommunications in Somaliland

The project will ensure that high speed wireless technology capable of delivering sufficient scalable bandwidth to residents of Somaliland is available at the site.

Get Price

What is a Base Station in Telecommunications?

Discover the role and functionality of a base station in telecommunications networks. Learn how these critical components manage communication

Get Price

base station in 5g

The base station in a 5G network is designed to provide high data rates, low latency, massive device connectivity, and improved energy

Get Price

How to Create a Communication Room That Meets

Learn how to design a communication room (通信机房) that meets industry standards, ensuring safety, efficiency, and scalability for your

Get Price

pmwj94 Jun2020 Abdihali Fashina Fankunle Scope

Finally, it states that the paper aims to explore the approaches, impacts, constraints and practices of using project scope management for

Get Price

Ministry of Post & Telecom inaugurates communication rooms

Financed by the World Bank through the ICT Support Project, 37 communication rooms were installed at key five institutions for each of Somaliland, Puntland, GalMudug,

Get Price

The Role of Telecommunications in State-building: The Case of

Fortunately, Somaliland is among the countries that have been attending and benefiting from the advancement in the telecommunications sector. This research explores the role of

Get Price

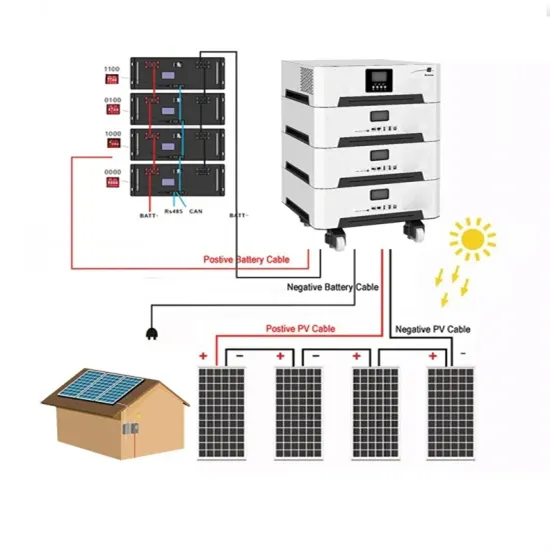

Telecom Base Station PV Power Generation System Solution

The communication base station installs solar panels outdoors, and adds MPPT solar controllers and other equipment in the computer room. The power generated by solar energy is used by

Get Price

TABLE OF CONTENTS

To position Somaliland as a regional leader in the adoption and utilization of 5G technology, driving digital transformation, innovation, and socio-economic growth for the benefit of all citizens.

Get Price

A New Dawn For Somaliland Telecom Sector? Or Is It?

Since all communications are now slowly becoming all IP networks the government will have to work on the idea of setting up the first Somaliland Internet Exchange

Get Price

Annex B Telecom Service Requirements for Buildings (CST

What is stated in the Saudi General Building Code shall be applied mandatorily, and in the event of a discrepancy/conflict between the requirements of the Guide (CST-GUIDE-101.3-24) with

Get Price

An overview of the applications of project scope

overview of the applications of project scope management in the telecommunication industry with a focus on telecommunication projects in Somaliland. The approaches, impacts, constraints

Get Price

Somtel – website

Somtel is a leading Telecom and technology service provider with the widest network coverage in the Somali region. From our headquarters in Hargeisa and guided by our values, we are

Get Price

An overview of the applications of project scope management in

Consequently, this paper attempts to review the overall picture of the applications of project scope management in the telecommunication industry with the aim of exploring the

Get Price

Telesom First

Telesom First marks our relentless pursuit of innovation and excellence across the telecommunications, ISP, and mobile financial services sectors in Somaliland. As the pioneers

Get Price

A New Dawn For Somaliland Telecom Sector? Or Is It?

Since all communications are now slowly becoming all IP networks the government will have to work on the idea of setting up the first Somaliland

Get Price

Telecoms Sector Guide | SomalilandBiz

Depending on an operator''s technology, even a site hosting just a single mobile operator may house multiple base stations, each to serve a different air interface technology (CDMA2000 or

Get Price

Top-Rated Efficient telecom tower shelter

The telecom tower shelter come in an extensive collection comprising diverse designs and sizes so that every organization finds the most suitable for their telecommunication needs.

Get Price

6 FAQs about [Somaliland Telecom Base Station Room Project]

What telecommunications companies are in Somaliland?

Blank Somaliland Map. Telecommunications in Somaliland, an internationally unrecognised republic claimed by Somalia, are mainly concentrated in the private sector. A number of local telecommunications firms operate in the region, including Golis Telecom Somalia, SomCable, Somtel and Telesom.

How is telecommunications regulated in Somaliland?

Somaliland’s Telecommunications Sector is regulated by the Ministry of Posts & Telecommunications based in the national capital, Hargeisa. On 13th June 2011, the House of Elders passed the law, without any amendments, on an overwhelming majority of 75 for, 1 against and none abstaining.

How does Somaliland's telecoms work?

Somaliland’s telecoms consumers are able to make the cheapest local and international calling rates in the world. Customers can conduct money transfers and other banking activities via mobile phones, as well as easily gain wireless access.

Is Somaliland a telecommunications country?

Prior to Somaliland’s re-independence in 1991, the telecoms sector was heavily monopolized by the central government led by the corrupt regime of Siad Barre. Since the overthrow of his regime, Somaliland has developed a modern and telecommunications industry with widespread mobile usage among the populace.

Could a lack of standardization affect Somaliland's telecoms sector?

This lack of standardization in Somaliland’s telecoms sector could potentially have serious repercussions for the sector and limit the ability of the state to broaden their tax revenues among Somaliland’s leading operators.

Does Somaliland need a telecommunication & finance framework?

Somaliland’s government needs to a develop framework for the entire sector—a sector growing at the point where telecommunication and finance meet. Despite telecoms being one of Somaliland’s largest sectors it has never led to substantial tax revenues for the government.

More related information

-

Saint Lucia Telecom Base Station Room Project

Saint Lucia Telecom Base Station Room Project

-

Are there batteries in the power supply room of the telecom base station

Are there batteries in the power supply room of the telecom base station

-

Middle East 5G Base Station Communication Construction Project

Middle East 5G Base Station Communication Construction Project

-

Gambia Communication Base Station Self-Powered Project

Gambia Communication Base Station Self-Powered Project

-

Mali 5G communication base station inverter construction project

Mali 5G communication base station inverter construction project

-

Yaounde 5G communication base station inverter grid-connected project

Yaounde 5G communication base station inverter grid-connected project

-

What is the proportion of mixed energy in the base station room

What is the proportion of mixed energy in the base station room

-

Tanzania Telecommunication Base Station Wind Power Project Section

Tanzania Telecommunication Base Station Wind Power Project Section

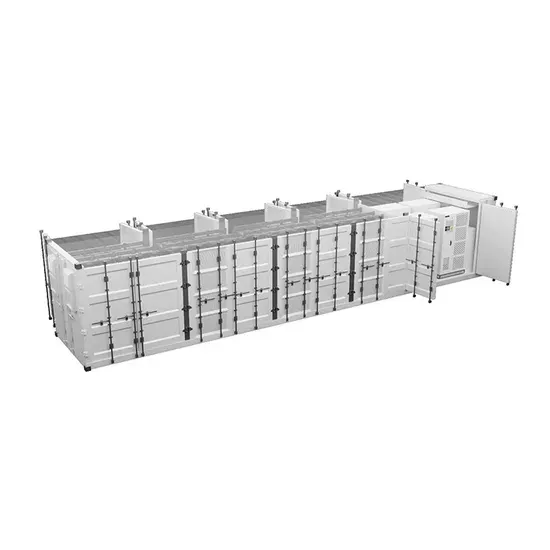

Commercial & Industrial Solar Storage Market Growth

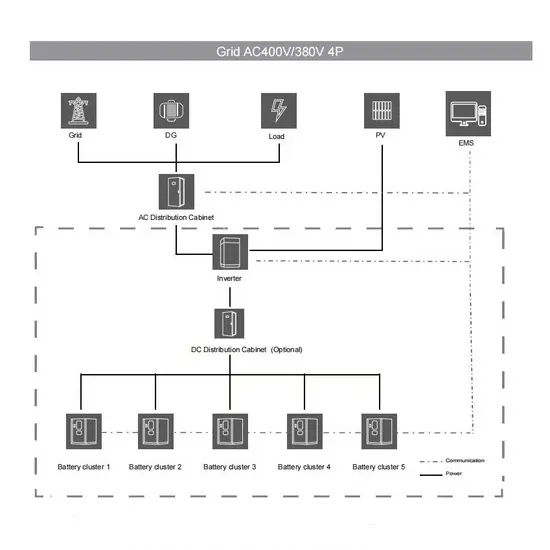

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with a 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with a 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at a 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have significantly improved ROI, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.